It is the AGE of social media!

Starting from a simple Myspace account to the hustle-bustle of Twitter, social media has evolved like nothing else. But, it was always a western affair.

Until a Chinese app came in and took the world by storm. Suddenly, Gen Zs, millennials & boomers alike, went from lazily scrolling through feeds to dancing in front of their phones.

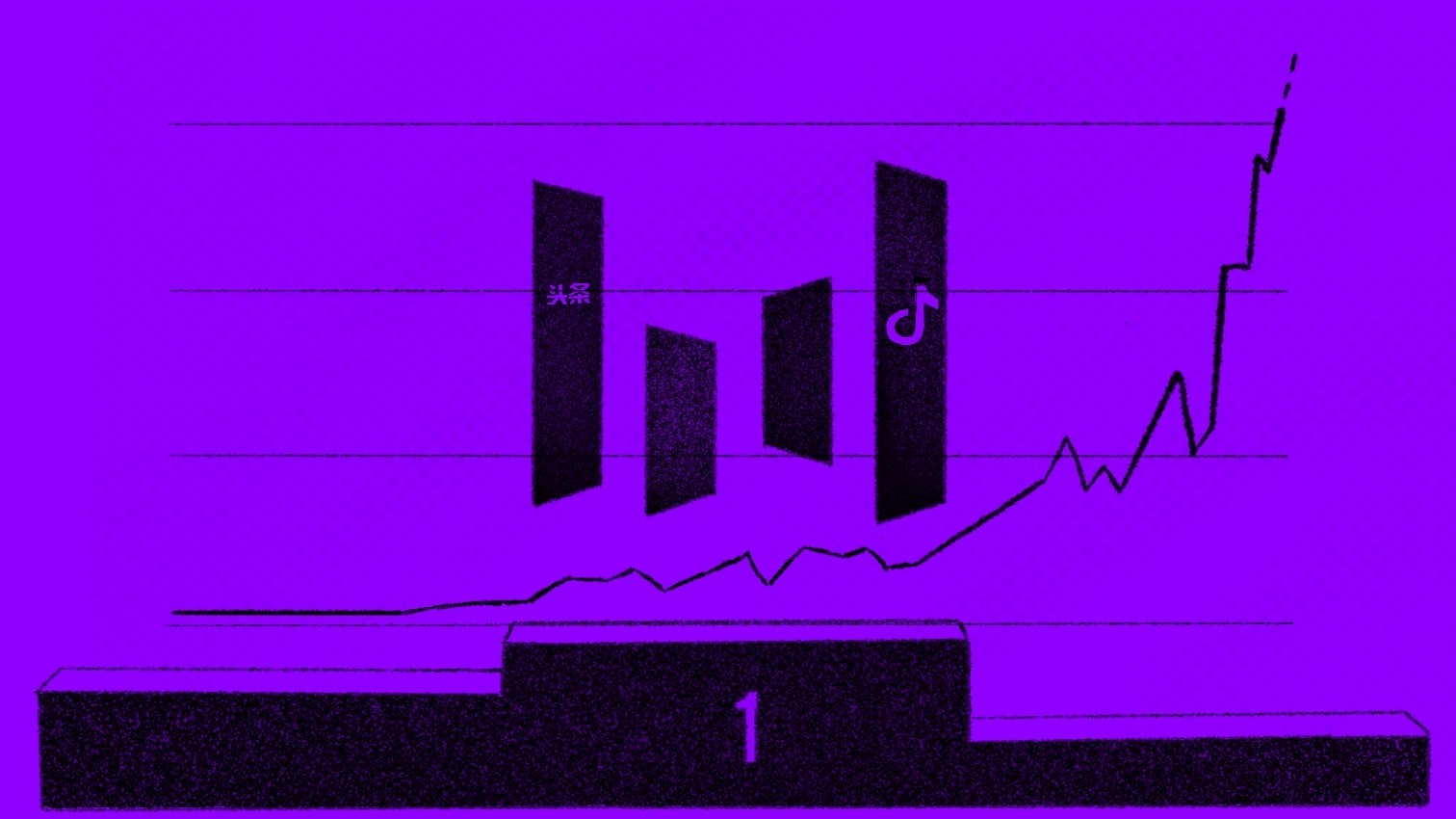

Of course, you know I am talking about TikTok. TikTok is a video-sharing app that gained 1 billion users more quickly than any other social media app ever. It is now downloaded an overwhelming 3 billion times!

Now the world, at large, knows a lot about TikTok, but not many know about its parent company ByteDance. ByteDance founded in 2012, bested the likes of SpaceX, Stripe & Canva, to become the world's most valuable startup.

So, how did ByteDance do it? Well, let's find out ByteDance's secret weapon to a valuation of over $400 billion dollars!

What exactly is ByteDance?

Zhang Yiming & Liang Rudo, the co-founders of ByteDance, are quite a team!

A microelectronics student turned software engineer, Zhang Yiming had an affinity for startups. Before launching ByteDance, Yiming had worked at several different startups, be it a travel website called Kuxun or leaving Microsoft to join a startup called Fanfou.

He & Rudo, together launched their first venture, a real estate search startup called 99fang.com, in 2009. But they quickly moved on, in 2011, to attempt something BIG, something different.

Yiming & Rudo had realized that the world was moving from computers to smartphones. The quick success of applications like Snapchat & Instagram was enough evidence.

So, they set out to create ByteDance, a technology company that buildds a suite of applications in different domains, including content, entertainment, news, etc.

Since its launch in 2012, ByteDance has grown to a revenue of $58 billion dollars & currently has a monthly user base of 1.9 billion across all its platforms.

ByteDance's army of apps!

The strength of ByteDance lies in its ability to pump out apps like they were popcorn. In just 2 years, ByteDance has created over 140 products in 11 different verticals!

Among them, the most famous products being:

- TikTok / Douyin — short-video sharing app

- Jinri Toutia — AI-driven news app, that displays very user-specific news (& ads).

- Xigua Video — YouTube-like app that is based on publishing video-based content (short & long form)

- Helo App — a social networking platform

- Lark — one-stop collaboration tool that included chat, calendar, content creation, cloud storage, etc.

- BytePlus — a B2B startup that sells AI-powered technology to companies.

Now, ByteDance is also dabbling in the world of Metaverse, with a new social networking app called Party Dance. It also plans to enter the gaming industry very soon.

If you consider the popularity of these applications in the Chinese market & dominance of TikTok worldwide, only Facebook's family of apps could rival this list.

And to think these successful platforms were built all within a period of 10 years is mindblowing.

In fact, the app Douyin (the original TikTok) was developed in just 200 days!

So, what is the secret behind ByteDance's rapid innovation?

ByteDance's secret weapon

So, ByteDance is a resounding success. But, how did it grow to such heights so quickly?

Well, ByteDance's secret weapon is its brilliant organizational structure, ie the way it has created its SSP — Shared Service Platform.

Wait, but what is a Shared Service Platform?

A Shared Service Platform or SSP basically groups business functions or resources that are used by multiple teams in an organization.

In an SSP, you'll typically have centralized business units for functions like finance, human resource, tech, etc. So there won't be multiple HR teams for different parts of an organization. A centralized HR team handles everything, here.

Confused? Well, let me elaborate.

- Suppose a company has X different teams working on Y different new projects. Each of these teams will need some common resources to help with various stages of the development process.

- In the SSP model, all these resources/business functions are centralized for the entire organization. This way, individual teams can freely access them.

So, from a bird-eye-view, there is a concentration of knowledge in terms of specialized teams, that serve as resource/knowledge pools for individual projects.

Got it, but is ByteDance's SSP any different?

ByteDance implements this but on a whole new level.

- ByteDance has created extremely centralized & specialized teams for different business functions called SSP teams.

- So product teams can rely on the expertise of these SSP teams to aid with different parts of the development and growth processes.

- For instance, ByteDance has an SSP team that specializes in user research. So when a product team carries out user research for a new product, the SSP team can help the product team out.

- Similarly, while developing a product, the product team connects with SSP-level engineers to leverage previously developed algorithms & technologies to fast track the development process.

- The basic idea is to create a centralized and focused knowledge group & very flat hierarchies so that these SSP groups can incrementally develop on their own. Their development naturally helps all different teams in the organization.

- Teams like the development team, user-growth team, content team, analytics team, etc, all together form the entire SSP at large.

ByteDance's SSP is different from other companies in the sense that usually the product teams there don't receive organization-wide specialized support. For instance, product teams will have to carry on with user research using their own resources.

The ByteDance kind of system results in very small & focused product teams, and a wide SSP.

Hmm, but why is ByteDance's SSP model so effective?

The effects of this organizational structure are very evident in the products that ByteDance chooses to create.

For example,

- BytePlus is basically ByteDance selling its very effective AI algorithms that drive the search features in products like Tik Tok.

- Next, ByteDance is aiming to release a short video app for children, which with its experience with video apps should be easy to implement.

- With Douyin built in 200 days & ByteDance's education app built in just 120 days, it's very clear that the SSP model rapidly speeds up the development process.

Now, you are probably wondering why such a centralized system is so effective. Well, the reasons are quite simple.

- You see, with the current structure, ByteDance has two major parts

- the SSP teams that specialize in particular verticals and,

- the product teams/other units

With the high-level expertise of SSP teams, the 'small & focused product' teams are tasked with broadly exploring all the market areas and opportunities for ByteDance's next billion-dollar app.

- This sort of constant exploration allows ByteDance to bring out high-quality products one after another. For example, product teams also find out ways to recycle the technologies already developed into new product ideas!

- With specialized SSPs & successful products, ByteDance accumulates knowledge very quickly in a given sector. It leverages this advantage by working on very similar products that target different user groups & use cases. For example, ByteDance has a range of video-based products, from editors to social media-like platforms.

- The SSP model has a huge effect on the speed of development as well. Because no product team has to start from scratch. With the experience of individual SSPs, teams can very easily integrate complex technologies into new products.

Overall, the model seems to be very cleverly optimizing for the resources Bytedance already has.

Although, people will forever debate whether to centralize or de-centralize. But, given how effective this structure is ByteDance, as a startup founder, there are surely some lessons you learn from this!