Amazon made ~$110bn revenue in the 3rd quarter of 2021. Its cash cow, AWS (Amazon Web Services), was the star performer again, bringing in ~$5bn profits on ~$16bn revenue!

Well, no surprises there. In fact, the common narrative is that AWS subsidizes everything else at Amazon. It generates a lot of cash so that Amazon can spend it on other things.

But here's the interesting and lesser-known part. There's another business unit at Amazon that has also brought in ~$5bn profits last quarter, on just $8bn revenue!

Fasten your seat belt, you're about to learn a whole lot about Amazon's advertising business.

What are Amazon Ads? Isn't Amazon an e-commerce company?

Yes, Amazon is an e-commerce marketplace. Millions of users visit Amazon every day to buy products from various sellers. This naturally puts Amazon in a place where they can "recommend" things to users — products from a certain brand or seller or products of a particular type.

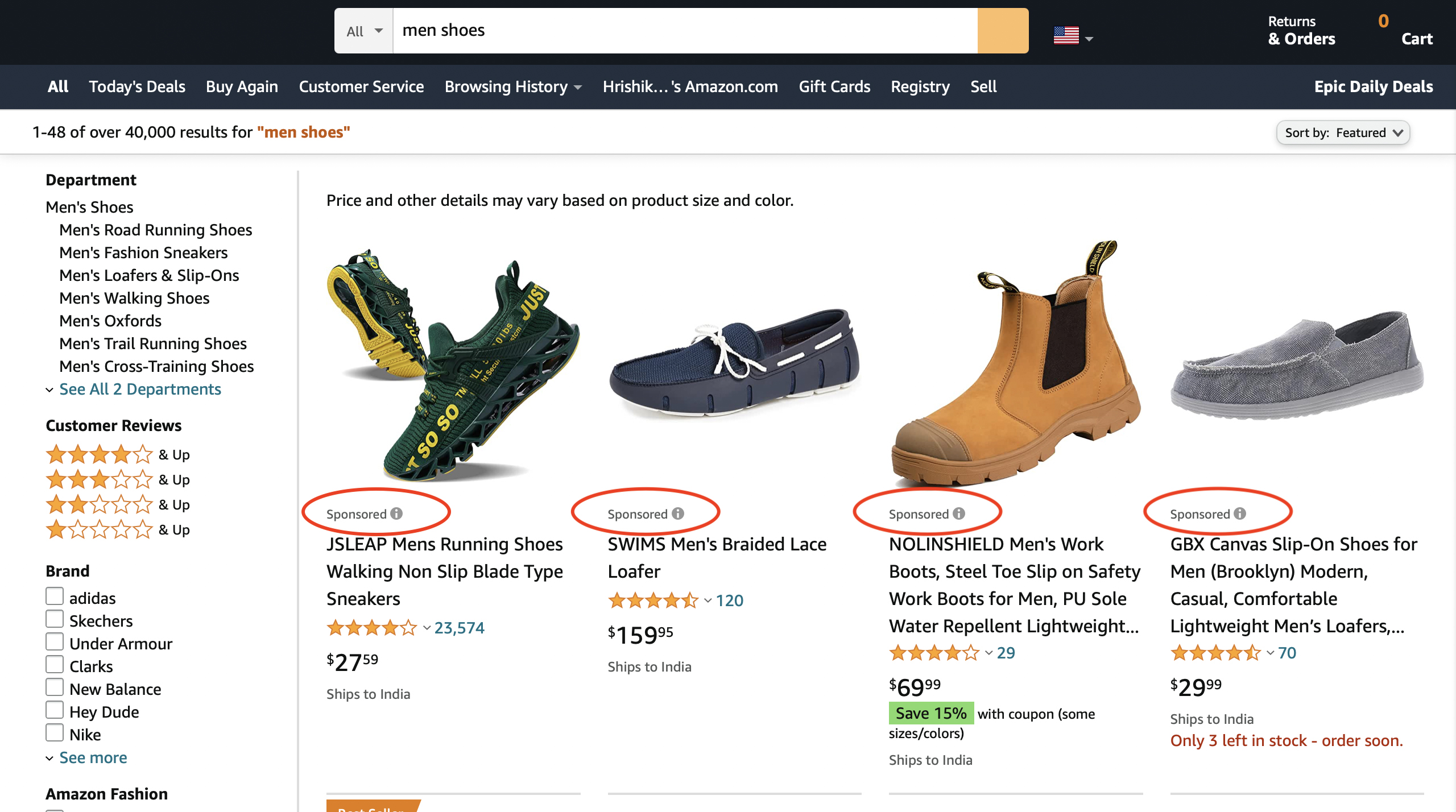

For instance, if you type "men shoes" on Amazon, you'll be greeted with 1000s of results from popular brands like Nike, Adidas etc. and even the lesser known ones. Amazon can now "recommend" certain shoes at the top, so that it's easier for you to make the right choice.

In the early years, these were organic recommendations based on your location, past purchase history, etc. Those are now replaced by "paid recommendations" or put simply, "ads".

So brands pay Amazon to show up at the top of these search results. Amazon puts a "sponsored" tag on such results, when displaying them.

"But Hrishikesh, I know how sponsored ads work. The question is why would brands pay Amazon for this?"

Well, these are the most prominent reasons:

- Amazon receives a huge amount of traffic.

- Users have high intent of purchase when they search on Amazon vs. say, Google. For ex. when I search for "men shoes" on Google, I might want to generally read up about "men shoes" and not buy a pair right away.

- People use Amazon to do product research before buying anything online. A recent study in India showed that 50% of all users visit Amazon before they make an online purchase anywhere.

So say you work in the marketing team at Apple and you've a budget allocated for ads to increase sales & brand awareness. Given the reasons above, you'd probably spend more on Amazon ads vs. say, Google or Facebook.

But Amazon Ads is not just about search ads

Now here's the more interesting part. Amazon Ads is not just ads that show up when you search something on Amazon.com.

Brands can put up banners on Amazon's homepage and product pages.

They can also place ads on:

- FireTV, Twitch, MiniTV — Video Ads

- Alexa — Voice Ads

- External partners (eg. news websites) — You pay Amazon and they programmatically place your ads on partner websites.

So again, if we look at this from the perspective of a brand like Apple, they get to advertise on multiple platforms and in multiple formats (text, audio, video ads).

Advertising giants, Google & Facebook, have built a huge ad network over the years. Google, for instance, has search ads on Google.com, video ads on YouTube, and a platform (display network) that allows you to advertise on all its partner websites.

Amazon is building a platform of similar scale and in a similar fashion. And it's already a serious threat to the leaders, Google & Facebook.

Amazon Ads vs AWS — Who wins?

Let's get into the numbers now!

First, we have AWS

AWS is Amazon's star performer & cash cow.

AWS will make ~$62bn in revenue this year. It earns 30% profit on this, so Amazon will make ~$19bn in profits from AWS in 2021.

Then we have Amazon Ads

Now, Amazon Ads will make ~$35bn in revenue this year.

While Amazon doesn't reveal how much profit they earn on this revenue, we can take the proxy of Google that has a 68% profit margin (yes, that's huge!).

Let's say Amazon earns 60% profit on top of $35bn ⇒ ~$21bn!

Yes! Amazon Ads will possibly make Amazon more money than AWS this year!

Comparing business models

But that's not it. Let's take a quick look at the business models for AWS & Amazon Ads.

In the case of AWS, Amazon needs to buy more infrastructure like servers or data centers every year to generate additional revenue.

For Amazon Ads, these costs are — well, almost nothing!

So, all additional revenue for Amazon Ads keeps adding as profits at a much higher margin :)

Woah! How does it stack up against Twitter & others?

I pulled out the revenue numbers for Q3, 2021 and here's how they look:

Twitter — $1.14bn

Snapchat — $1.07bn

Pinterest — $633mn

Spotify — $736mn

If I add up all of these numbers, I end up with a combined revenue of $3.2bn.

Amazon Ads has ~$8bn revenue in Q3, 2021. That's 2.5x of Twitter, Snapchat, Pinterest & Spotify combined!

In the US alone, Amazon Ads is the 3rd biggest ads business after Google & Facebook. It currently has ~12% market share, which is predicted to grow to 15% by 2023.

Clearly, Amazon Ads is huge. But more importantly it's the most lucrative business for Amazon right now. And it's growing fast at the expense of Google & Facebook.

So you either died in 2000 or lived long enough to be an ad target of each of the FAANG, or should I say MAANG 😛

P.S: We're not done yet! In the next article, I want to show you how everything is becoming an ad network and how privacy changes are creating winners (Amazon, Walmart) & losers (Facebook, Snapchat). Stay tuned!