Last Wednesday, Ambani & Adani overtook Mark Zuckerberg in net wealth, when Zuck's worth dropped by a whopping $31 billion!

Facebook has been facing the heat for a long time now, but last week was a debacle when their shares fell by 26% in a single day 🤯 (even the renaming to "Meta" didn't help much, huh, Zuck?)

No one knows what's in store for FB or Meta in the future, but this great crash sure makes for an interesting story. So read on!

What led to Facebook's loss

Now Facebook has been in the news for all the wrong reasons in the recent years. They have been charged with heavy fines for misusing private user data, and you will often see #deleteFacebook trending.

But the fact remains that Facebook has seen a steady increase in the number of users right from the start. Not a single quarter in 18 years with a dip in daily users.

Until the 4th quarter of 2021 that is. The global daily users fell by 1 million compared to previous quarter and all hell broke loose.

But get this -- Facebook's global daily users fell to 1.929 billion from 1.930 billion in previous quarter. That's a mere 0.05% drop. So why create so much fuss over it?

Well, there are 2 ways to look at this:

- This is possibly the beginning of a dark future for Facebook. So the 0.05% drop is a signal that Facebook will see further decline in the coming years.

- The stock market is possibly over-reacting. Facebook's family of apps (Facebook, Instagram, Whatsapp etc.) already has a huge user base, and such minor ups & downs are inevitable.

Either way, there's more to the story than just declining users.

Apple's mischievous hand in all of this

Facebook makes money entirely from ads. They know a lot about you, not just based on the information you share through their apps but also from all the activity you do on your phone or computer.

But here's what happened in 2021. Apple launched a new policy where users had to explicitly say YES to tracking & sharing their information.

Well, who would say yes to that. At just the first update of iOS, 62% of users opted out of this tracking!

Of course, Facebook took a real beating. They lost $10bn as a result!

So what's next for Facebook

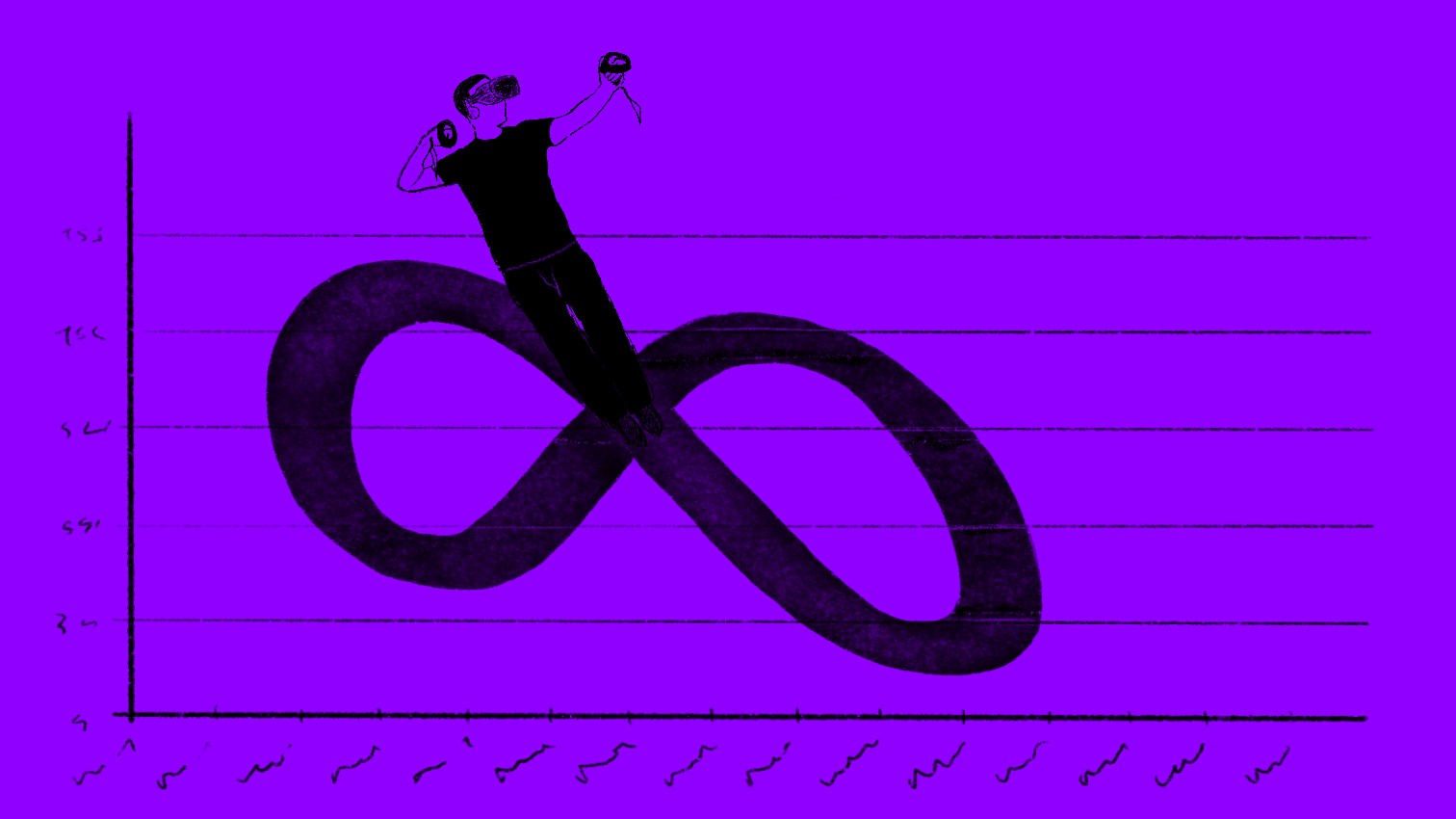

Facebook's big bet is the Metaverse narrative. There are 2 big tech players in this space right now -- Microsoft & Facebook.

Microsoft wants to buildd the Metaverse narrative for virtual offices & collaboration, while Facebook or Meta aims to buildd it with a social angle.

Metaverse is a high risk, high reward bet. And Zuck is clearly all in. They lost over $10 billion on this last year, but it's all insignificant if Facebook's bet plays out well.

Of course, only time will tell if the Metaverse becomes a reality and who wins the race. For now though, Facebook has a bumpy ride ahead.

Social media games getting more competitive

Facebook and its family of apps have already made it big in social media. There's no denying that. But there's also stiff competition from TikTok & YouTube.

TikTok, which is just 6 years old, has more than a billion users and is one of Facebook's biggest rivals. Along with YouTube, it pulls in the young crowd and keeps them hooked.

Advertising revenue, as we saw before, has also taken a hit for Facebook. Advertisers in general have many options to choose from now -- TikTok, YouTube, and even e-commerce platforms like Amazon & Walmart.

So clearly just the social media bet may be a risky one for Facebook.

But Zuck isn't as naive as you or me. After all, he bought Instagram in 2012 for just $1 billion, and look how it's become the face of the company now.