Very few companies survive beyond a 100 years. In fact, here's what Jeff Bezos said:

"One day, Amazon will fail...We have to try and delay that day for as long as possible"

It was quite eye-opening that the CEO (now ex-) of a large behemoth will say this. Blunt as it may be, it has a TON of truth in it.

Well, before you forget that, let's introduce the Tata Group:

- Founded in 1868 and a cool 153 years old

- Has 28 publicly-listed companies valued at $300 billion+ (market cap as of Sep 2nd, 2021)

- Yet manages to maintain a beloved status in the country

Now, after a century of dominance, Tata has set its sight on the idea of building a Super App!

And today, the idea is finally realized with the launch of Tata Neu — a Super App that's set to challenge the likes of Amazon, Flipkart, and Jio Mart!

But, given how old Tata is, it can be considered a fossil in the business world 😛

How then is it managing to stay relevant in the "Age of Startups"? And, how does this Super App play into this strategy?

How has Tata stayed relevant for so long?

If we over-simplify this, staying relevant involves having foresight to:

- Expand into newly-thriving industries

- Make shrewd acquisitions

Tata has done this and more :)

Let's just take the last few decades for example:

- TCS

India experienced an IT boom in the 1990s. Guess when TCS was founded? Not in the 80s or 70s, but in 1968! Today, it is the largest IT services company, not just in India, but worldwide.

- JLR

Tata even used the 2008 recession to its advantage by acquiring Jaguar Land Rover for ~50% of what Ford paid for it. In the next decade, Tata turned around JLR and established itself as a global car manufacturer.

- EV market

Fast forward to the present day, where electric vehicles are all the rage. Tata Motors were quick to spot the market gap in affordable EV cars in India. Now, it is the country's largest manufacturer of electric vehicles — capturing ~75 % of the market.

But, is Tata really successful?

Well, when it comes to generating profits, there is just one company in Tata's stable that stands out — TCS. This company alone contributes to about 75% of the group’s profit.

To understand the difference, let's take a look at Titan Company. Despite being the second most valuable company in the group, its net profits are ONLY 3% that of TCS!

Naturally, the Tata Group is not very happy about their dependence on TCS.

What moves is it making in the "Age of Startups"?

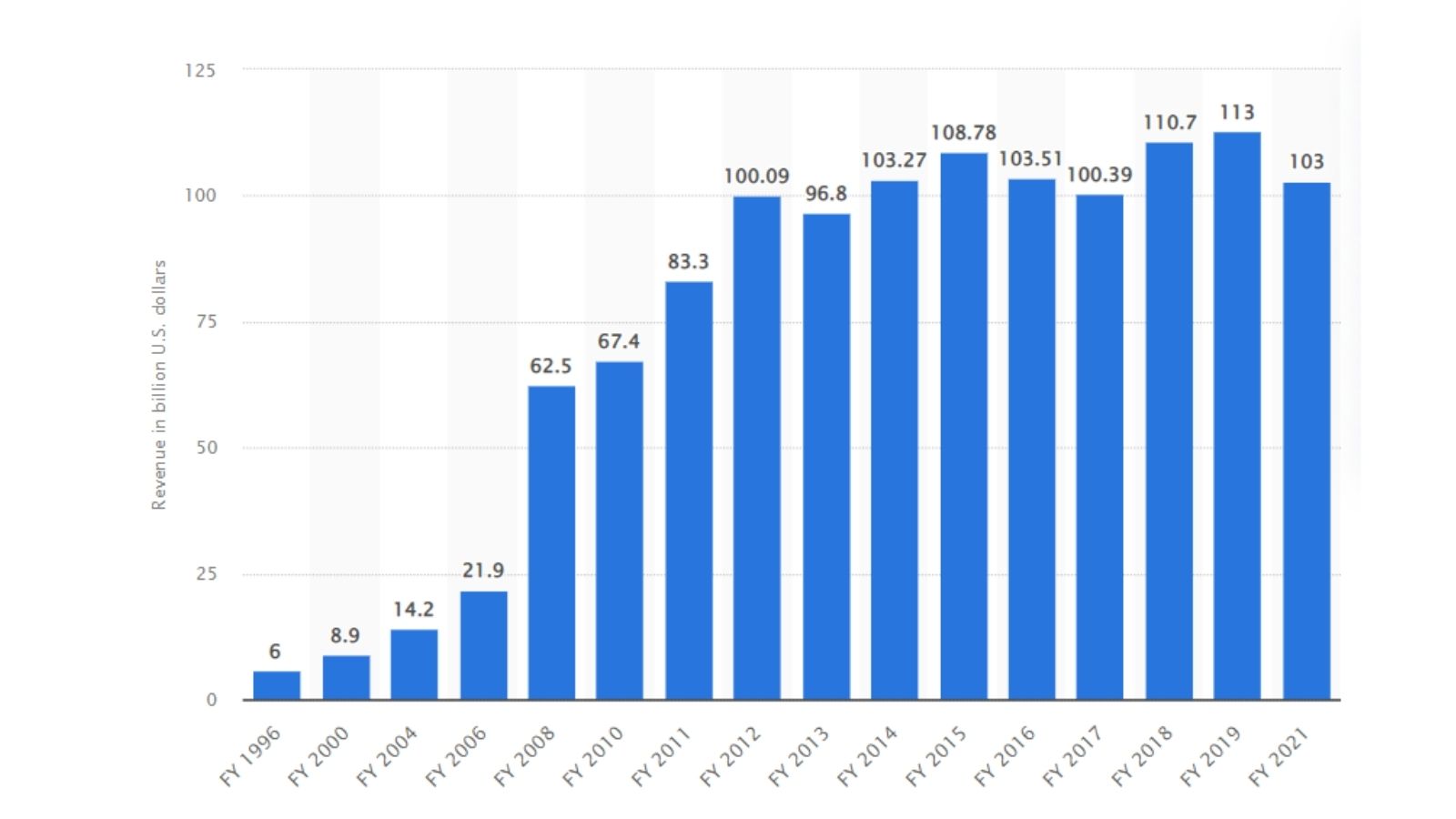

Even though the Tata group generated a whopping $103 billion in revenue, this figure has been more or less the same in the past 8 years. i.e they aren't growing anymore.

At this critical moment, Tata needs to identify new growth opportunities. And this leads us to their recent startup acquisition spree.

Here are some of the deals done by Tata (through Tata Digital):

- BigBasket: TD (Tata Digital) acquired a 64% stake. The company clocked gross sales of $1.1 Bn or INR 8,000 Cr in FY 2021.

- CureFit: TD invested $75 Million and Mukesh Bansal, CEO of Cultfit & the founder of Myntra, joined Tata Digital.

- 1mg: TD acquired a majority stake in the largest digital health platform in India.

Clearly, Tata has realised it's late to the startup party. To make amends, it is buying already scaled startups.

Now, it can leverage the large customer base — of its existing businesses and new acquisitions — to execute its ambitious plan: the Super App.

"Super App"? Is everyone building a Super App?

Wait, what's a Super App?

Think of a Super App like a digital mall. And within this mall are other shops from where you can buy clothes, send money to your friends and even order food.

This was first popularised by WeChat - the OG Chinese Super App with 1.23 billion MAU. That's almost the entire population of India!

Now, the massive success of WeChat has inspired startup founders globally to build a SuperApp for their own country. For example, PayTM in India and Gojek in Indonesia.

OK, so why's it a BIG deal?

Let me explain. For tech companies, there are two important metrics:

- MAU (Monthly Active Users)

- Time spent on the app

Firstly, a person's phone is a very valuable "tech real estate" for tech companies. You see, an average person has just 40 apps on his phone. Of those 40 apps, more than half of them remain unused.

Now, apps with a single purpose are used less often and are most likely to be uninstalled. So, a logic that flows is — can we be multi-purpose?

Here is where Super Apps come in — rather than being specific to one function, they serve a variety of purposes. This means that a person will have more reasons to use the app regularly.

Of course, let's not forget, collecting a HUGE amount of user data is another motivation for Super Apps.

So, no surprise that companies like Amazon, Reliance and Tata are keen on building a Super App for the world's second-largest internet user base.

But, why is building a Super App so difficult?

Building a Super App is no easy task. There's more to it than just buying a few startups and combining them into one platform.

- Firstly, consider user journeys of millions of users, processing large amounts of data, managing hundreds of mini-apps, acquiring customers at scale, and so on.

- Moreover, Super Apps are not built on the Chinese internet, they ARE the Chinese internet. This means that there is no need for a person in China to download any other app apart from WeChat or AliPay.

But, that's not the case in India. There are specific apps for each industry. You have PhonePe, and Google Pay for payments. Amazon and Flipkart for shopping online and so on. And these companies have massive amounts of data about their users, making it difficult to challenge them.

While the rationale behind building Super Apps is interesting, just copying a Chinese playbook won’t work for Tata or any other company.

The PayTM app, for example, has over a hundred services that look super confusing and is already shutting down PayTM mall.

Enter Tata Neu — Tata's brand new Super App!

Unlike Paytm, Tata plans to approach building a super app by integrating multiple startups layer-by-layer.

The final outcome of this approach is Tata Neu — a super app by Tata Digital that's set to launch today, ie. April 7th!

The BIG idea here is to leverage IPL (currently ongoing in India) to market the app alongside the hype around the cricket league.

The app will combine TD's recently acquired startups and other services that include:

- BigBasket — to order groceries

- Croma — to buy electronic

- 1mg — to get a test

- Tata CLiQ — to buy clothes

- AirAsia — to book a flight

- IHCL — to book a stay... and more!

So this makes Tata Neu an all-in-one platform and puts it in direct competition with Amazon, Flipkart, and JioMart!

That's a tough spot to be in for a platform that's aiming to succeed as a Super App, and not just an e-commerce platform. It has to be executed perfectly to achieve this!

From what we know, the application is far from perfect. Initial testing among Tata employees suggests that the app is buggy, slow, and a far cry from being the WeChat of India.

The only incentive for customers is a reward system via "NeuCoins".

With this new app, Tata will be immediately placed in competition with giants of the respective industries. So, it'll have to buckle up if it hopes to have any chance to succeed & not end up becoming another Paytm.