Think of India and you immediately picture vibrant, crowded streets where sophisticated professionals and day workers both consume their daily dose of chai at the local tea shop. With ~1.4bn people, crowds are definitely justified.

Someone is either buying or selling something here, at all times. As a result, India's retail market today is a trillion-dollar business.

With new e-commerce startups emerging each day, the main agenda is to move this retail market online. So, users can access more sellers and in turn sellers reach more buyers.

For now, though, most of this retail market still operates offline. In fact, in 2021, the online retail market was only a $55 billion dollar business. That's less than 5% of the total market! So, there is a HUGE opportunity here.

Expanding this 5% share to just 20% could alone be a total game-changer. And, the Indian government's latest initiative aims for just that!

Of course, I am talking about ONDC. But, what exactly is this ONDC? How is it similar to another game-changing network like UPI? And, does it seriously have the potential to change the e-commerce space?

Well, I answer all these questions and more in this article. 🚀

Firstly, let's learn how UPI transformed financial transactions?

The comparison between UPI and ONDC is very appropriate. In fact, the ONDC network in many ways is built on the success of the UPI.

But, among the two networks, you and I have first-hand experience using UPI for transactions. So learning about how it works will surely help us understand ONDC better. So, let's get into it!

Transactions before UPI

Before UPI, transactions mostly used to take place through debit cards, credit cards or internet banking.

So, when you pay a store using your debit card, the following steps would be set in motion:

- The store's bank will contact your bank to confirm

- Once this is confirmed, the transaction takes place

a) Your bank details (pin, card number, etc)

b) And, if you have enough money to pay the owed amount

Essentially this transaction is an interaction between 2 banks facilitated by a mediator like Mastercard or Visa (depending on your card).

Transactions with UPI

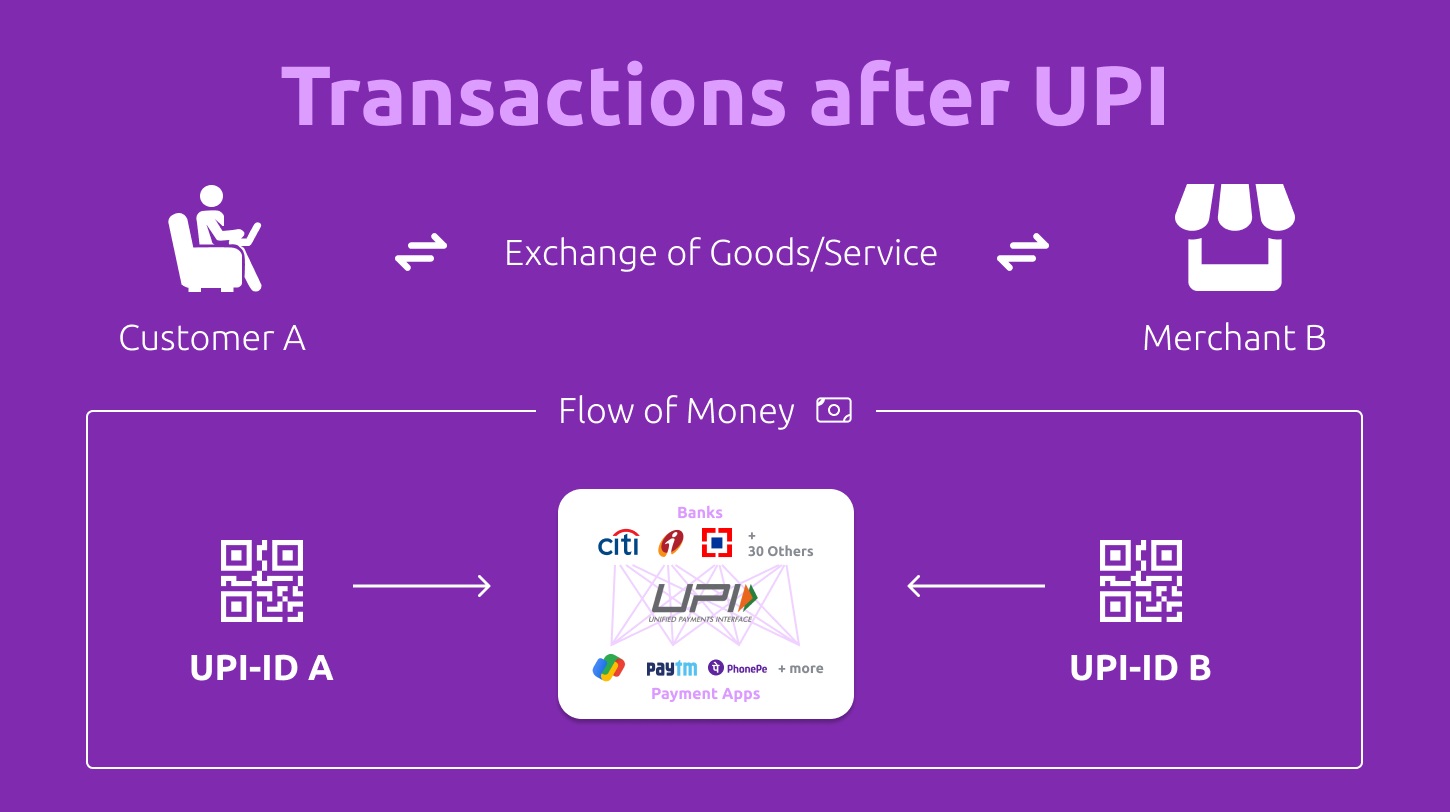

Now with UPI, instead of a bilateral transaction between 2 banks, there's a network of all the different entities like:

- banks = Axis Bank, ICICI, SBI, etc

- merchants = Any store that's offers online payment option

- payment platforms = GPay, PhonePe, etc

- apps = Paytm, Amazon, Zomato

- users that send or receive money online.

When you enrol on the network you link your bank details and phone number with a UPI ID and PIN. This information is stored in the network. So, you only have to look up a phone number or scan code and enter the pin to make a transaction.

So, in the previous system, the interaction happened in isolation where the customer's bank sends money to the seller's bank and there is a transfer of information.

But, via UPI, the transaction happens through an established network which already includes the details of Buyer A + Bank A + Bank B + Seller B. All it has to do is fetch that information and connect all the parties to make the transaction.

So, what is ONDC & how is it similar to UPI?

ONDC stands for Open Network for Digital Commerce. So, like UPI connects banks, sellers and customers into a network, ONDC also connects different e-commerce entities into one network.

Let me explain this with an example!

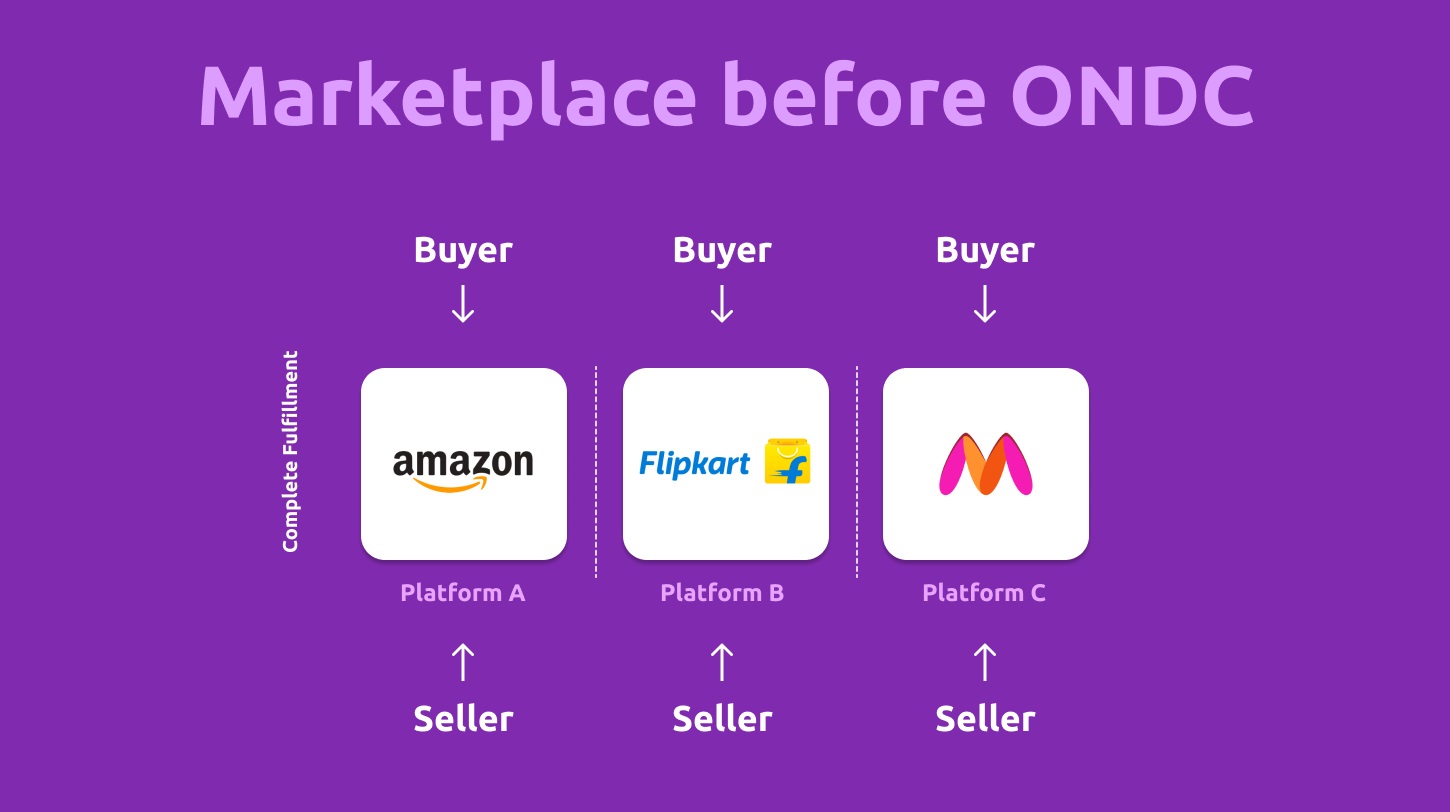

Platform model

Suppose, you use a platform like Amazon to buy a product online.

- USER = You

- PLATFORM = Amazon

- SELLER = Retailer selling his product on Amazon

Here, the USER is connected with the SELLER via Amazon, a PLATFORM. So, all the steps like

- Discovering the product

- Order placement

- Shipping and Delivery

are fulfilled by Amazon.

So, it's safe to say that this interaction all happens in isolation on Amazon and is mostly enabled by a platform.

ONDC model

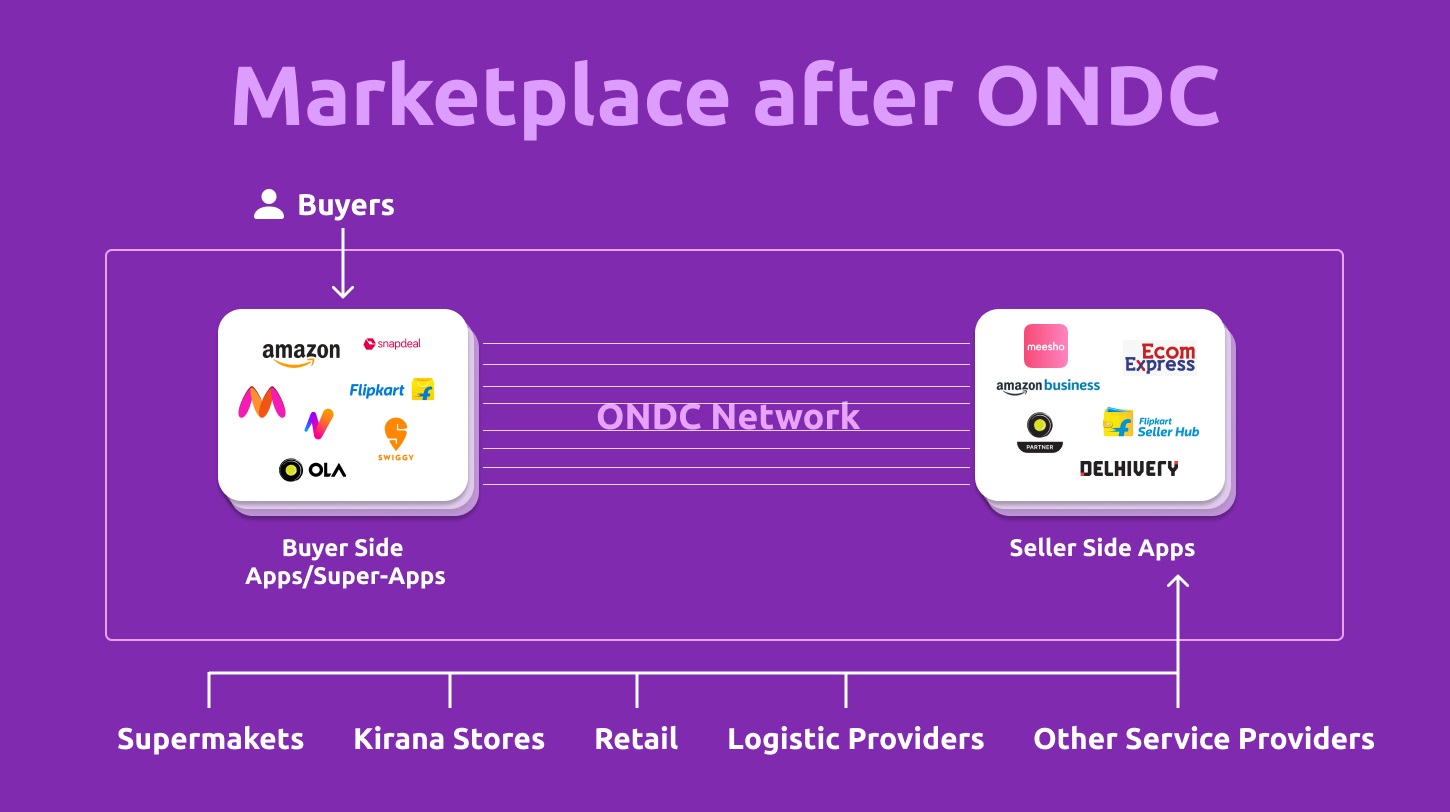

ONDC breaks this platform dependency by creating a network that will eventually onboard different entities like:

➝ Platforms and Aggregators - Amazon, Flipkart, Paytm, Swiggy, Zomato

➝ Sellers - Retail stores and restaurants onboarded on these platforms

➝ Logistics fulfilment - Dunzo, Goodwill

Now, once all these e-commerce players are onboarded on the network, ONDC does 2 things

- Unbundles their functions

- Enables interoperability

Confusing, right? Let me explain in more detail.

Amazon in our previous example was performing a couple of different functions:

- It brings the user

- Onboards the seller

- Connects them both

- Handles all the order details

- And, finally delivers the product

Now, with ONDC all these functions are "unbundled" meaning divided, and different parties can fulfil each of those functions. The unbundling, enables "interoperability" between different players to efficiently fulfil a single task.

So for example,

- function 1 (bringing the user) ➝ can be done by Amazon,

- while functions 2, 3, 4 (onboarding seller & handling the order) ➝ can be done by a local retailer on say, E-Samudaay

- and function 5 (delivery) ➝ can be done by Dunzo

I'll explain this better with a proper example in a minute. But, before that, let's first understand what ONDC is not!

Is ONDC a Super App?

Now, since ONDC is essentially "hosting" all these different functions you are bound to wonder if it's actually a new Super App!

Well, the simple answer to this is NO.

ONDC is NOT a Super App OR platform OR an application. It's not another app on your phone. And, it's also not a mediator between these parties!

ONDC is a technology like UPI. So, like UPI holds the details of all the parties participating in the financial network. ONDC also holds the details of all the platforms and the many million sellers that participate in the e-commerce network.

Plus, it is a set of protocols that lists the rules for how the interaction between the parties will take place. So, it is like a SUPER network that enables interactions between all the parties and sets rules for these interactions.

Now, UPI is usually plugged into different apps. For example, you can pay via UPI on Swiggy. Similarly, ONDC can also be plugged into different e-commerce apps like say, Paytm.

So, when you open Paytm, you can access the ONDC network. This means you can access all the buyers and sellers in the network that may or may not be affiliated with Paytm.

But in practice how will ONDC work?

Let's take a real-life example to understand how ONDC will work when implemented.

- Now, users usually have 2-3 famous apps like Paytm, Amazon, and Flipkart on their phones.

- Say you log into Paytm to buy a packet of bread. When you search for bread on Paytm, it shows you 2 options:

- Bread by local Kirana store - Rs. 40 (no delivery)

- Bread by BlinkIt - Rs. 120 (with delivery)

- You choose the bread from the local Kirana store and now you need to choose a service to fulfil the delivery. You go with Dunzo which offers the delivery service for Rs. 30.

- Your total order value of Rs. 70, which you pay online using UPI.

- Now, via the interactions on the ONDC network, Dunzo's delivery guy reaches the Kirana store picks up your bread and delivers it to you.

So, here:

Paytm ➝ brings the user

Kirana store ➝ provides the product

Dunzo ➝ delivers the product

All three parties work in sync and the value created is also distributed accordingly.

But, what problems does ONDC aim to solve?

ONDC has very ambitious goals:

- For starters, the main aim of ONDC is to expand the market and onboard more mom & pop retail stores online. In the next 5 years, the aim to to

- increase the GMV (Gross merchandise value = value of all the products sold) from INR 4.5 lakh crores ($58B) to INR 7.5 lakh crores ($96B)

- onboard 40 lakh total retailers from the original 20 lakh

- increase buyers from 9 Cr to 20 Cr

- The second goal is to remove dependency on large players like Amazon and Flipkart that bring in the bulk of the users. This will allow retailers to go online on their own terms without adhering to marketplace rules set by big players and still reach a huge volume of users.

- Take the power away from aggregators like Amazon, who use their power to control the marketplace and even replicate popular products to sell under its own retail brand.

- Help niche retailers get discovered quickly online without having to worry about setting up a delivery/logistics system and attracting customers.

- Create solutions on top of the pre-existing network. Like PhonePe or WhatsApp pay that was built on top of UPI.

So, will ONDC be the next UPI?

UPI was clearly a resounding success. Just in 5 years, the volume of transactions via UPI went from 2.38 lakhs in 2016 to 10 lakh crores in 2022!

ONDC leverages the same systems that make UPI so successful. In fact, given the scope of ONDC, it won't be an overreach to say that it is UPI on steroids!

But, with complex systems come complex problems.

ONDC aims to deal with big players like Amazon, Flipkart, Zomato, Paytm, and Google who all aim to maximise their own profits.

From, the large-scale platform's perspective, they bring in the bulk load of users to the network. But, since they can offer more competitive prices and discounts, they'll also gain some benefits. It's still unclear how participating in a large-scale system like ONDC will change these companies.

On top of that, we are also not sure how ONDC plans to list products for different search queries. Ultimately, some products will be ranked higher compared to others in the results. So, for small retailers will the network become a larger, more impossible landscape they have to compete in?

There are a lot of questions that'll only be answered after the pilot run is over. And, we are eagerly waiting to learn more & to see if ONDC actually changes things for the better.