Whatsapp has changed the way we communicate! Pictures, videos, and even voice messages have taken it beyond being a simple messaging app.

And it’s wildly popular, especially in India. WhatsApp has 2 billion monthly active users (as of 2022)[1] and 20% of those users are from India.

But has WhatsApp made any money for Meta? More importantly, does Meta even have a plan to buildd a successful business out of WhatsApp?

Well, the answer to the latter question is a strong yes. But Meta’s plan to make money from WhatsApp is a line of business you’d have possibly not heard of — WhatsApp for Business i.e. making money from other businesses.

So, in this article, we’ll dig deep to understand WhatsApp for Business and how it will make money for Meta.

WhatsApp’s first business model

WhatsApp was founded as a messaging app in 2009. By 2013, WhatsApp had already become very popular with 200 million+ annual users across the world.

Till then, WhatsApp was entirely free to use. Now, the founders chose the most obvious way of making money from WhatsApp.

They allowed users to use the app for free for a year. After which, the users would be charged a tiny fee of $1 every year to continue using the app.

Now, at its peak (2016), WhatsApp touched 1 billion annual users[2]. This would mean they could make $1 billion in revenue through this subscription model!

Of course, a huge number of users would have possibly shifted to a free alternative like Telegram and the actual revenue would have been much lesser.

In reality though, this is what happened. Meta (or Facebook, back then) acquired WhatsApp in 2014 and in 2016, they announced that the $1 fee was permanently removed[3].

Facebook said that it wanted to generate revenue from WhatsApp in a more “meaningful” way in the future.

Making money from businesses: The more “meaningful” way

Traditionally, businesses have communicated with their potential and existing customers using telephone calls, emails, and text messages.

Enter WhatsApp with its reach of 2 billion users, and ease of use. Imagine if these businesses start using WhatsApp to communicate with their customers.

Businesses would reach users on their preferred channel where people spend most of their time. Plus, the conversations don’t have to be text-only, and these parties can easily exchange pictures & videos making the conversation more engaging.

In the same announcement of 2016, Facebook also said that it plans to buildd tools that allow people to communicate with businesses & organizations via WhatsApp. For instance, talking to your bank about a suspicious transaction or checking the status of your flight with the airline[4].

But how much money can WhatsApp make from businesses?

It all comes down to numbers now! Is WhatsApp’s business offering lucrative enough for Meta?

Revenue from a single business in the lowest slab

Now, WhatsApp charges businesses based on the number of messages sent. As the number of messages increases, the price per message goes down.

In the lowest slab, you’re charged $0.0085 per message for the first 250,000 messages sent and these are all the pricing slabs.

So if a business signs up at the most basic slab and sends all messages allowed, this is the revenue it brings to Meta:

- Revenue per message ⇒ $0.0085

- No. of messages ⇒ 250,000

- Total revenue ⇒ 250,000 x $0.0085 ⇒ $2,125

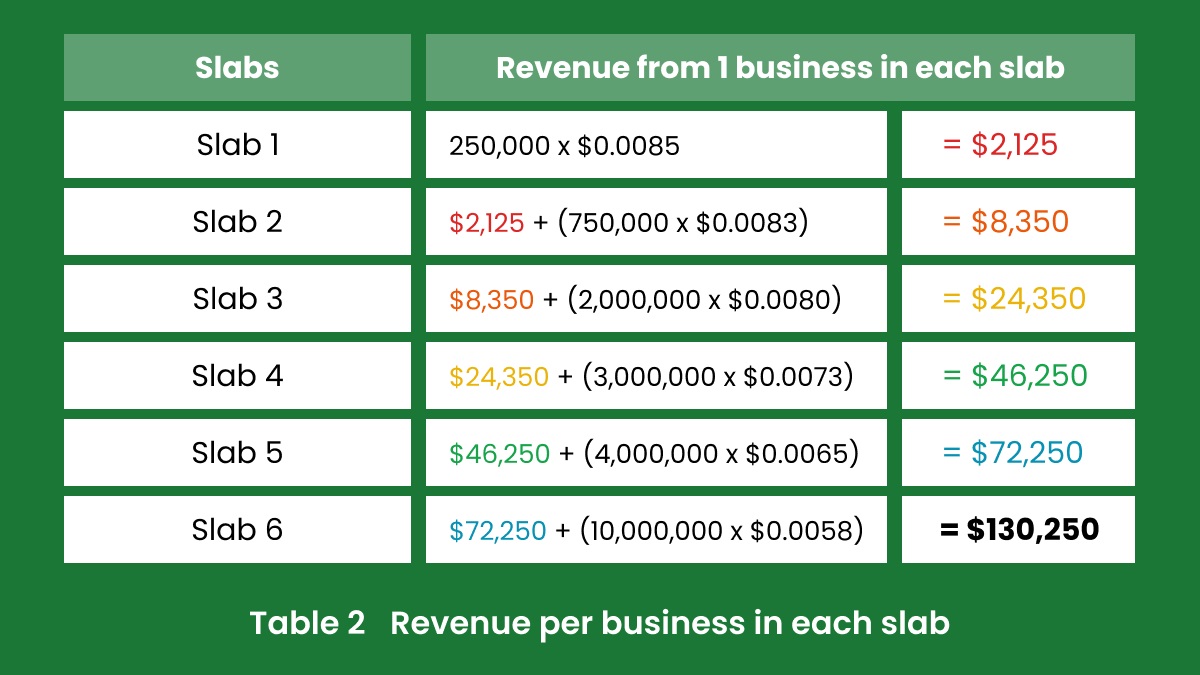

Revenue from a single business across all tiers

Now, let’s look at the revenue generated by WhatsApp from a single business in all of the six slabs.

To keep things simple, we’re assuming that all messages in each of the slabs are utilized entirely by the business. For Slab 6, we’ve assumed an average of additional 10 million messages sent beyond the first 10 million messages.

Revenue from all businesses

Finally, let’s look at the total revenue WhatsApp could potentially generate across all businesses in India.

- There are 1.43 million businesses registered in India under the Ministry of Corporate Affairs[5].

- Let’s say 35% of these registered businesses eventually end up opting for WhatsApp for Business. That comes to 35% x 1,430,000 = ~500,000 businesses.

- We have split these 500,000 businesses across the various pricing slabs, keeping just 1% i.e. ~14,000 businesses in the highest slab.

- Finally, we merge table 2 (revenue per business in each slab) and table 3 (number of businesses in each slab) to arrive at the total potential revenue for WhatsApp.

So, WhatsApp for Business stands to make ~$9 billion in revenue, just from India!

Of course, onboarding 500,000 businesses isn’t as easy as it sounds and may take a lot of effort and time. But what if Meta were to focus their energies on clients in the highest slab i.e. slab 6?

Targeting big businesses for more money!

Meta is already in talks with several large companies over the last few years, many of which are testing the features[6] of Whatsapp for Business. Some of these big names are Netflix, Uber, Hilton, Home Depot, Four Seasons etc.

The story in India is quite similar. Consider the case of Bharat Petroleum Corporation Limited (BPCL), for instance. BPCL is an oil and gas company, owned by the government.

85 million users reach out to BPCL via calls & text messages. In a year, BPCL broadcasts 700 million promotional messages![8]

Now, WhatsApp is already working to get BPCL onboard. But how much money can a single client like BPCL bring in?

Revenue from BPCL

- BPCL broadcasts ~700 million promotional messages every year.

- Assuming the best pricing of $0.0058 per message (slab 6),Revenue = 700 million x $0.0058 = ~$4.1 million.

- On top of this, users can also initiate conversations with BPCL. Such conversations are charged at a lower rate of $0.004 per message[7].

- Currently, 100,000 customers use BPCL’s WhatsApp bot daily. That’s 100,000 / 85,000,000 * 100 = 0.12% of its user base.

- BPCL is still in the early stages of WhatsApp adoption and developing its bot. Let’s say this number goes up to 1% eventually.So, number of users for BPCL’s WhatsApp bot daily = 1% x 850,000,000 = 850,000.

- Daily revenue from the bot = 850,000 x $0.004 = $3400.So, yearly revenue = $3400 * 365 = ~$1.3 million

- Total revenue WhatsApp makes from BPCL = $4.1 million + $1.3 million = $5.4 million!

Interestingly, WhatsApp already makes ~$4 million in revenue from CRED[8], which is one of the highest spenders on WhatsApp for Business in India.

But what is WhatsApp doing to acquire these businesses?

Now, WhatsApp’s proposition is already quite solid. They have built a wildly popular channel, that people are addicted to. On top of that, they also offer features like sharing pictures, audio & video files vs. your traditional text messaging.

But Zuckerberg is not the one who will wait for customers to come in organically. WhatsApp already has a yearly promotional budget of ~$30 million to grow the business.

A part of this budget is given to businesses as a fund to buildd & improve their WhatsApp bot and processes. For instance, BPCL has already received INR 1 crore from this fund![8]

Closing thoughts

Clearly, the numbers indicate that WhatsApp for Business can be a money spinner for Meta!

For businesses around the world, it will open new avenues of communication and direct reach to customers in an engaging way.

Meta clearly has a secret weapon in its arsenal. But how effective it turns out will depend on how well Meta executes its plan.

From how we’ve seen Zuck & Meta operate over the years, huge business success seems a likely scenario 😉

References

[1] https://www.statista.com/topics/2018/whatsapp/#dossierKeyfigures

[2] https://www.statista.com/statistics/260819/number-of-monthly-active-whatsapp-users

[3] https://en.wikipedia.org/wiki/Timeline_of_WhatsApp

[4] https://www.sec.gov/Archives/edgar/data/1326801/000132680115000032/fb-9302015x10q.htm

[7] https://developers.facebook.com/docs/whatsapp/pricing

[8] https://the-ken.com/story/whatsapp-business-in-india-the-ace-up-metas-sleeve

%20(1).jpg)