It's official — Jet Airways is finally making a comeback!

On January 13th, 2023, the National Company Law Tribunal (NCLT) gave a green flag to Jet Airways' acquisition by Jalan-Kalrock Consortium.[1]

Some much-needed good news for the airlines, its employees, pilots, investors and creditors after a 4-year-long gruelling episode.

But, in hindsight, Jet Airways' demise was somewhat inevitable. Its balance sheet was in ruin, its debt crossed $1 billion dollars, and it was clearly losing money and for that matter market share. But, as obvious as Jet Airways' sudden crash was, it still left many hurting. Thousands of employees were left hanging without pay for months.

But, how did India's oldest and once largest private airlines turn out to be such a colossal mess?

Well, let's understand all the reasons that caused Jet's downfall!

The slow rise of Jet Airways

Jet Airways' journey began after the 1991 deregulation act by the Indian government. It was the first private airline to enter the game. But, it didn't go straight to the commercial market.

It first leased 4 Boeing 737s to start its own air-taxi company, pioneered by industry giant Naresh Goyal. Only in 1995, did Jet enter the passenger services wing of air travel. They placed an order for 10 planes to Boeing and soon enough, they accumulated a market share of 20%.[2]

But, even in the beginning years, everything was not smooth sailing for Jet. The company was backed by Gulf Air and Kuwait Airlines both having 20% stake. But, after the 1997 act, where foreign companies were banned from taking an equity stake in Indian companies, the 2 Gulf airlines left Jet.

As a consequence, Naresh Goyal was left with 100% ownership of Jet Airways. Leaving him as the sole authority of the airlines for years and years to follow.

Fast forward to the future, Naresh would make many mistakes that might not have occurred if Jet had the backing and expertise of its Gulf parents.

So, what caused the downfall?

For many years, Jet Airways enjoyed the low competition landscape. It went public in 2004 and for years it was the market leader in the airline industry.

By that point, although Jet was making losses, it had still maintained some years where it made a profit. But, everything changed in the 3 years of 2006, 2007 and 2008!

So, what happened then?

- Well, in 2006, many low-cost carrier airlines like Indigo, SpiceJet and Go Air entered the industry.

- In 2007, Jet Airways paid through the teeth to buy loss-making Air Sahara, forever putting a dent in its balance sheet and debt numbers.

- In 2008, the global financial crisis drastically affected the fuel price pushing every single airline to make losses, except Indigo of course.

Low-cost carriers give Jet a tough time

Now, the latter 2 points seem fair, but why were low-cost carriers such a threat to Jet Airways?

Well, let's understand this from the context of the Indian air travel market.

- No matter the industry, one fact remains always true — Indian consumers are a price-sensitive bunch. The middle class, which rose to significance in the early 2000s as a whole values money, time and efficiency. Luxury is not their main priority.

- This automatically makes the industry low yield, meaning the profit margins remain very very thin. On top of this, Indian airlines spend up to 34% of their revenue on fuel, while the global average is only 24%. This further squeezes their margins.[3]

Now, low-cost carriers are basically airlines that provide the bare minimum amenities to their passengers. So, NO extra leg space, NO hot towels or free coffee, and NO free food. They also have a uniform seat structure.

On the other hand, full-service carriers like Jet Airways, do provide these amenities along with premium seats.

Let's take Indigo as the Low-cost carrier. If we say both Indigo and Jet Airways charge the same air ticket fare and make INR 2000 on a single passenger, then:

- Indigo:

- Spends 34% on fuel ➝ 34% of INR 2000 ➝ INR 680

- And, let's say they spend 30% on logistics and staff payments ➝ 30% of INR 2000 ➝ INR 600

- Total spent ➝ INR 680 + INR 600 ➝ INR 1280

- Jet Airways:

- Spends 34% on fuel ➝ 34% of INR 2000 ➝ INR 680

- Spends 20% on food and extra services ➝ 20% of INR 2000 ➝ INR 400

- And, let's say they spend 30% on logistics and staff payments ➝ 30% of INR 2000 ➝ INR 600

- Total spent ➝ INR 680 + INR 400 + INR 600 ➝ INR 1680

Now, given Indigo's low cost, it can afford to sell its tickets for lower. And, that's what it does. To undercut the full-service competition, low-cost carriers deliberately sell tickets at a much lower margin.

So, if Indigo sells the ticket at INR 1400, it still makes a profit of INR 120. But, Jet Airways makes a loss of INR 180 for the same price.

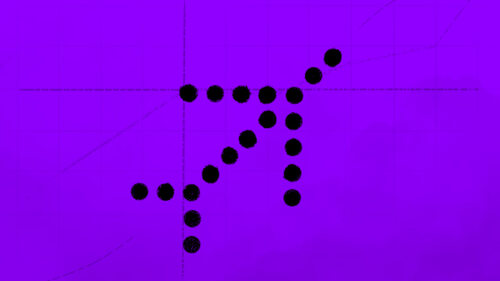

All in all, due to the tight margins pushed by low-cost carriers, Jet Airways was suffering in spite of having a larger market share. And, slow enough, Indigo was chipping away at Jet's market share harming it further.

Due to this dynamic, India is famous for having the cheapest airfares. Most players aim for volume, rather than increasing cost!

Loss-making acquisitions make the situation worse

Now, while Indigo and SpiceJet were eating up Jet's share, Jet Airways was also busy digging a huge hole in its finances.

In order to increase its market share and create a low-cost subsidiary for itself, Jet Airways decided to buy Air Sahara. Air Sahara was another airline with bungled finances but it was well-known among Indian consumers.

Jet was ready to pay $500 million in Jan 2006 to buy the airlines, but the discussions fell through. After a few months, Jet purchased Sahara for $340 million. The expert consensus was clear, Jet had paid too much money for Sahara and altogether it put a huge load on Jet's balance sheet.[4]

They rebranded Sahara to JetLite (missing out on Sahara's brand name to get customers). With the acquisition, Jet now had a market share of 32%. But, apart from this, Sahara didn't do much for its parent company.

In another ill-advised partnership, Jet Airways made a strategic alliance with Kingfisher airlines in 2008. This is when both their finances looked something like this compared to Indigo:

- 2006-2007

- Indigo — (-) INR 201 crores

- Jet Airways — (+) INR 41.6 crores

- Kingfisher — (-) INR 577.3 crores

- 2007-2008

- Indigo — (-) INR 234.7 crores

- Jet Airways — (-) INR 423 crores

- Kingfisher — (-) INR 408.9 crores

- 2008-2009

- Indigo — (+) INR 82 crores

- Jet Airways — (-) INR 402 crores

- Kingfisher — (-) INR 1902 crores

The alliance didn't age well, as Kingfisher had to shut down in 2012. The loss-making airlines were almost Doomed through Association - Sahara, Kingfisher, and Jet Airways.

Too much debt is never good

Apart from these problems, Jet Airways was making other mistakes. In fact, it had almost gone bust in 2013. But, Etihad Airways rescued it by investing $380M and buying a 24% stake in the carrier.[5]

The major issue was mismanagement. Jet Airways only had one main leader on the ship, Naresh Goyal, who operated a tight management group. As the acquisitions happened, the same full-service carrier management handled the low-cost carrier wing. That obviously didn't work, as both these models need very different management styles.

The fuel price also kept fluctuating during this time and Jet's debt was piling up little by little, in spite of the Etihad Airways investment. In 2018, the milk finally boiled over, as Jet had reached over a billion dollars in debt.

Goyal and the team were in desperate need of rescue again, but the situation had worsened to such an extent that rescue didn't come this time.

The comeback and what to expect?

In 2019, Jet Airways was grounded permanently.

- Jan 1st, 2019 — Jet Airways delayed its payment to its Indian bank lenders

- Jan 11th, 2019 — Etihad refused to sink more money into Jet

- Feb 8th, 2019 — Jet grounded 4 aircraft as it failed to pay the lenders

- Mar 19th, 2019 — SBI and other Indian PSUs came to Jet's rescue for 1 condition, Naresh must step down as the chairman.

- March 25th, 2019 — Naresh Goyal steps out

- April 3rd, 2019 — Jet grounded more than three-quarters of its fleet.

- April 17th, 2019 — Jet completely runs out of money to sustain its operation. So, they are forced to suspend operations entirely.

Now, the whole saga has gone on for 4 years with multiple attempts to revive the dying airline. Finally, last week, Jet Airways' acquisition by the Jalan-Kalrock consortium got the green flag.

But, in spite of the good news, the hits still keep coming for Jet. Just yesterday, 4 Jet aircrafts were seized by Mumbai authorities over unpaid dues to employees.[6]

Now, the new owner is committed to running Jet Airways more efficiently. But, the company won't be able to so easily escape its past. The revival is set to happen in 180 days, so for the most part, we will have to wait and see!

%20(1).jpg)