For an industry known for flying people, it's funny how many airline companies have crashed to their death.

Think about the recent fall of Jet Airways, the crushing debt on Air India or even the complete vanishing act Kingfisher pulled years ago!

It's clear that the aviation industry is not for the light-hearted! And, will most likely turn billionaires into millionaires.

So, how then did a baby company like Indigo manage to stay profitable for 10 years straight? And, even beat the industry giants to acquire its ~60% share & "monopoly" status in the Indian aviation market?

Well, I was of course curious about this, so I did a bit of digging! Here is a complete breakdown of Indigo's GENIUS strategy that leaves no stone unturned. Let's go! 🚀

A little bit of history & how Indigo came to be!

The aviation industry is a pre-independence fossil established all the way back in 1938. It was founded by one and only J.R.D Tata. But, after 1947, the airline was renamed from Tata Airlines to Air India!

Since then, the government of India has had a strong hold on this space. That was until 1994 when India repealed all regulations & allowed private players to participate in the market. This deregulation gave birth to giants like Jet Airways & Air Sahara.

Now, in the late 90s and early 2000s flying via air was a costly affair. So, the status quo of the industry favoured the "air travel is a luxury" angle.

That changed when a bunch of low-cost carriers made a debut in the early 2000s, most notably — Indigo!

Interglobe Enterprise head, Rahul Bhatia, & IIT Kanpur grad and aviation industry veteran, Rakesh Gangwal, came together to launch Indigo in 2006. With Rakesh in the US & Rahul in India, the duo essentially built Indigo into an aviation monopoly by sitting 7000 miles apart! 🤯

Flight Wars: Indigo vs Jet Airways & Kingfisher!

Now, during the same time as Indigo, another high-profile airline was making its debut. Vijay Mallya's Kingfisher was also launched in 2005 & they were doing very well. In a couple of years, it expanded to become 2nd largest Indian airline after Jet Airways.

But, within a couple of years, these two newcomers went in completely different directions. While Kingfisher nosedived into oblivion, Indigo soared.

To understand how unprecedented Indigo's growth was, we'll first have to look at some numbers.

Indigo Vs Jet Airways Vs Kingfisher - Profit/Loss Numbers

- 2006-2007

Indigo — (-) INR 201 crores

Jet Airways — (+) INR 41.6 crores

Kingfisher — (-) INR 577.3 crores - 2007-2008

Indigo — (-) INR 234.7 crores

Jet Airways — (-) INR 423 crores

Kingfisher — (-) INR 408.9 crores - 2008-2009

Indigo — (+) INR 82 crores

Jet Airways — (-) INR 402 crores

Kingfisher — (-) INR 1902 crores - 2009-2010

Indigo — (+) INR 484 crores

Jet Airways — (-) INR 467 crores

Kingfisher — (-) INR 1293 crores

These numbers are extremely revealing.

- In the first 2 years, all three airlines were making losses. But in 2008, as the markets crashed and the fuel price ballooned, Kingfisher's losses increased by ~5 times.

- Surprisingly, in the same year, Indigo posted its first profit of 82 crores! 🤯 In the next year, the trend continued, till Kingfisher ceased operations in 2012. And, Indigo, on the other hand, remained profitable for the next 10 years!

The SECRET weapon to Indigo's success!

Indigo credits its sudden turn to profitability to its commitment to keeping its balance sheet extremely lean.

But, by nature, you have to enter the aviation industry with a truckload of cash. You are not paying $10 dollars for a domain name here, instead, you are literally buying a plane and filling it with super expensive fuel!

Indigo's GENIUS lies in how cleverly it has managed this entry-level problem using its "Sale and Lease Back" model. Let's learn more about it!

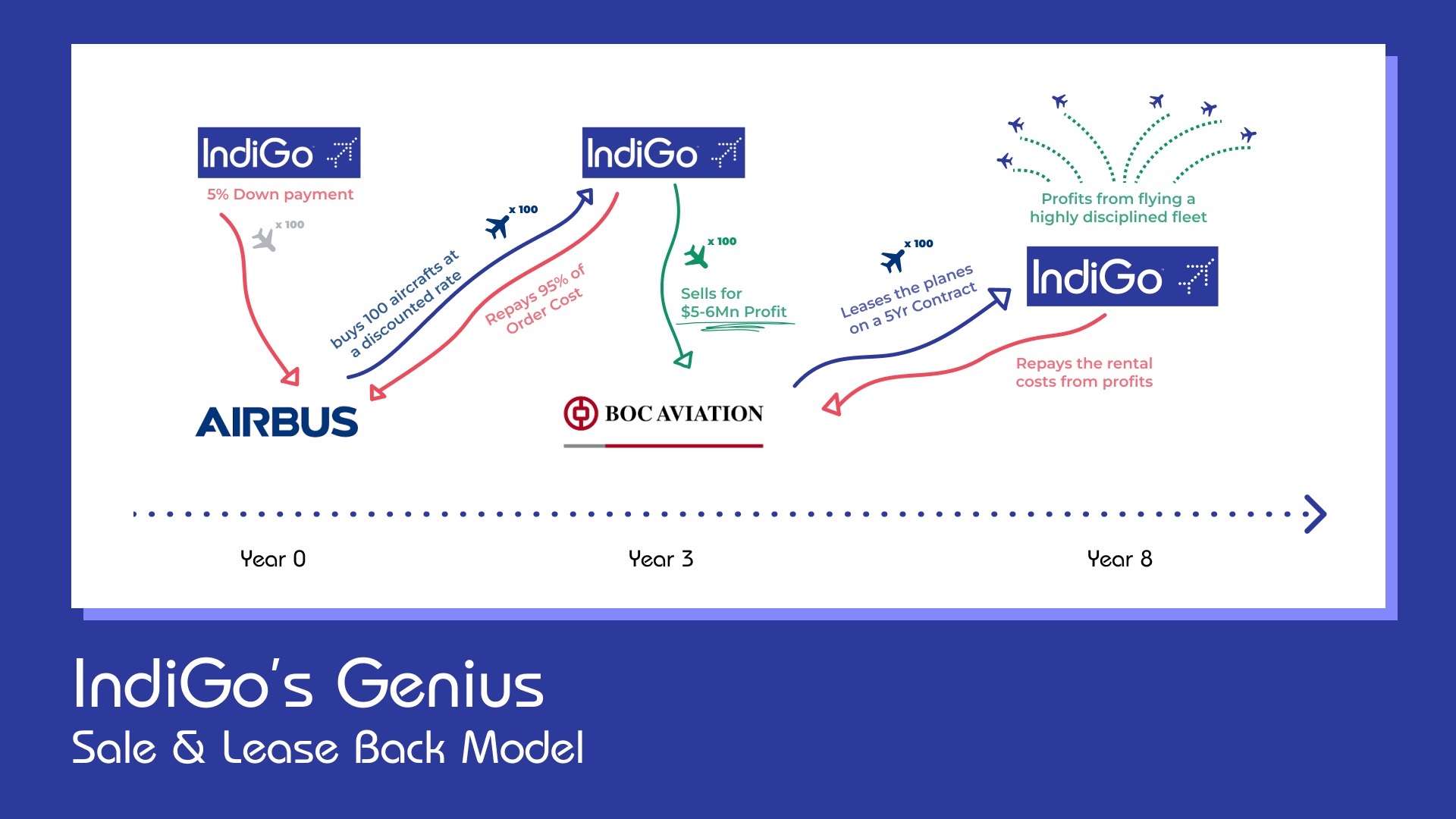

Sale and Lease Back model

In 2005, prior to its launch, Indigo decided to order a total of 100 aircraft from Airbus! Why? Well, bulk orders bring discounts.

During that time, Airbus was suffering from a bad reputation in the Indian market, because of multiple crashes. And, the other players were buying aircraft from its competitor, Boeing. So, Airbus was desperate to enter the Indian market. And, Indigo was its gateway.

- Given the large order size, Indigo bagged a discount of 40 to 50% from Airbus.

- Typically, the A320 aircraft is listed at a price of => $110M

- If we consider the best-case scenario, ie. a discount of 50%, which brings the cost price to => $55M

- Now, all the 100 planes don't arrive together. Indigo received its first plane in July 2006, and then received planes every few weeks.

- So, let's say for the first 20 aeroplanes the cost price remains $55M dollars.

- Now, what Indigo does is it pays a 5% downpayment to Airbus.

- And, when the planes arrive, it sells them to a leasing company like BOC Aviation at a profit of $5M.

- So, the selling price to BOC Aviation becomes => $60M & Indigo makes a profit of $5M!

- Now, Indigo leases back that same aircraft for a period of 5-6 years by paying a specific rent amount to BOC aviation.

- At the end of the lease period, the aircraft is returned to BOC Aviation.

With the revenue made by operations, Indigo then pays

- 95% of cost price to Airbus, and

- The periodic rent amount to BOC aviation

- Plus, given aircraft depreciate over time & their maintenance costs increase, a 5-6 year lease period works very well.

The goal is to not make profits from the Sale and Leaseback model, although that's an upside.

But, this model helps keep Indigo's balance sheet super light & cash flowing. Indigo swears by this model, and over 80% of Indigo's fleet is leased compared to the industry average of 40-50%!

Now, the sale and leaseback model is not always ideal. You see, with newer versions of planes, like the new A320 NEO, the lease rentals also climb up, effectively increasing the periodic fixed cost. So, many airlines prefer owning part of their fleet.

Indigo also at one point backtracked from this model. But, with smaller margins, it eventually went back to the model again.

How does its super-efficient operation keep it flying?

Although the sale and lease back model makes for a great foundation, there is more to Indigo's profitability story.

Again, let's see the contrasting strategies of Kingfisher & Indigo.

- Airlines Configuration

Indigo ➝ Stuck to 1 configuration, ie complete economy.

Kingfisher ➝ Experimented with dual configuration, ie. 14% business + 86% economy. - Expansion

Indigo ➝ Stuck to domestic & only later expanded to short-distance international flights.

Kingfisher ➝ Spent Rs 550 Cr to buy Air Deccan & went for long-distance international, ballooning its costs! - Bare bones strategy

Indigo ➝ Only offered the bare minimum - one seat and little leg space.

Kingfisher ➝ Provided entertainment + food + and, Kingfisher's famous mini-water bottles 😂 - On top of this, Indigo only buys one kind of plane - Airbus's A320s CEO & NEO. This keeps its maintenance cost super low.

- Indigo's operations are extremely efficient. It focuses on keeping flights in the air for a minimum of 12 hours per day. That's very efficient compared to the industry average of 10 hours per day.

This is a typical story of why "Go Big or Go Home" is a huge myth!

Unlike KingFisher, Indigo expanded slowly depending on its capacity. And, with high operation efficiency & no loose ends, they became the largest airline in India in 2012!

On the other hand, KingFisher's massive spending & high losses made it impossible for them to continue operations.

Lessons:

- Startup battles are regularly won by people who can run longer than those who can run faster.

- Make things work ⇒ Make things fast ⇒ Make things beautiful.

- Startups are built by doing simple and "boring" things, consistently, over long periods of time.

10 years of profitability and road ahead

If you look at Indigo's journey, you'd wonder how a company entering such a crowded space could beat industry giants & capture ~60% of the market share in just 15 years.

Well, Indigo did enter a crowded space, but unlike other airlines, it got one thing correct — India is a price-sensitive market. So, even if Jet Airways & Kingfisher offer you comfy seats & good food, an average Indian will still choose the cheaper ticket!

Plus, Indigo is extremely efficient, with on-time flights & very less cancellations.

So, Indigo basically entered a crowded space, understood what other players were doing wrong, kept their operations super lean & beat them at their own game!

Discovering competitors for your startup idea is NOT a source of sadness, but a validation of the market.

Now, after an awesome 10-year run, Indigo started making losses in 2019. And, with the pandemic & its expansion strategy, the losses increased. But, in Q3 of FY21, Indigo made a comeback with a small number of profits.

That didn't last, with rising fuel prices, a comeback from Air India (backed by Tata) & Jet Airways & increasing costs, the road to profitability will be difficult.

But, Indigo insists it will make it & we are not going to be the ones to doubt it. So, it'll be interesting to see how the AIR GAMES continue with the new-old players & if Indigo can keep its throne! We at buildd will continue to cover this, so stay tuned 😉