The news cycles have taken an unfortunate turn!

It seems like only yesterday when India got its 100th unicorn — the neo-banking startup, Open.

Together these 100 unicorns account for a collective valuation of $333 billion dollars[1]! So, by default, VCs were throwing their BIG bucks at these startups for the longest time.

But, in a weird twist of faith, before we could hear about our 101st unicorn the flood of back-to-back news items on employee layoffs have made an arrival.

The VC tone also quickly changed from "take my money!" enthusiasm to whispered caution. Caution about a looming recession!

It seems like the jolly old summer party for Indian startups is about to end. And, the WINTER is COMING!

Today, we are going to break down all the details about this dynamic. So, let's go 🚀

What goes up must come down

To put it simply, during the last decade, Indian startups have been raising money left, right, and center.

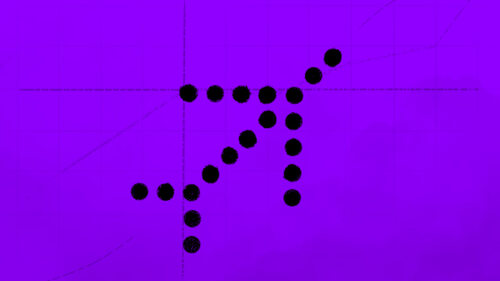

Just look at the numbers[1] over the last few years:

- 2017 ➝ Deals = 938, Value = $10.7B

- 2018 ➝ Deals = 964, Value = $9.9B

- 2019 ➝ Deals = 1127, Value = $14.7B

- 2020 ➝ Deals = 1088, Value = $11.2B

- 2021 ➝ Deals = 1376, Value = $36B

Now, following this trend, just in the first 4 months of 2022, Indian startups have raised $14.3B in funding[2]. That is literally 2x of the money raised during the same period in 2021.

But, just when it seemed like the happy days of endless cash would go on forever, a report predicting about a 19% fall[3] in funding in Q2 of 2022 came through.

More grim news followed this prediction, with VCs warning their startups to prepare for a runway of 18 to 24 months.

Among all the uncertainty, VCs were clear on one fact — startups shouldn't expect to raise more funds anytime soon.

Layoffs after layoffs after layoffs

The immediate effects of this development directly showed itself via employee layoffs. And, our ed-tech unicorns were the first to lead the way.

- Unacademy laid off over 1000 employees, that's about 17% of its workforce.

- Following this, only yesterday, Unacademy-backed ed-tech startup, Frontrow, laid off 145 employees, ie 30% of its team!

- Similar trend followed with Vedantu, where the ed-tech startup laid off 600 employees.

- The biggest unicorn BYJUs was saved from this grim faith. But, BYJUs backed WhitehatJr abruptly started pushing employees to work from the office, which prompted 800 employees to resign in a heartbeat.

- Adding to the list, another ed-tech startup Udayy was shut down yesterday, while its 100 employees were all laid off.

The trend is definitely not limited to just ed-tech. Zomato backed BlinkIt laid off 1600 of its employees. That's after Zomato spent almost $100M (overall, up to a $1B) to bail out BlinkIt just back in March.

In the e-commerce sector, Meesho also laid off 150 of its employees.

The overall tally of layoffs has now reached the 6000+ mark. So, things are definitely concerning.

The dried-up funding means that these high-growth-focused startups can no longer simply throw money at the problem. Seems like the days of 'crazy salaries' have come to an end!

The downturn is here! But, why?

But, what has caused the sudden shift in tone?

Well, a major reason is the arrival of an economic downturn. Or the fear-inducing word — Recession, that's predicted to be coming to the US shores!

Now, I am sure you're probably wondering what's causing this economic downturn.

Well, the biggest, most direct reason is the US central banks' hike in the interest rates.

As inflation in the US shot up to 8.5% in March of 2022, the highest in the last 40 years, the Fed decided to raise the interest rate from 0.75% to 1%.[4]

With the interest rates hiked, borrowing money would be more expensive. So, basically, this development is causing a pullback of capital from the global market (including India) causing liquidity problems for startups.

Moreover, according to Deutsche Bank, in its long history, Fed has never been able to correct inflation shoots without pushing the economy into a recession.[5]

On top of this, the war in Ukraine and the prolonged lockdowns in China have disrupted the global supply chain, affecting the entire global order.

In any case, although the recession is not certain, the global investors have become bearish with their investments. And, are definitely anticipating a slowdown/correction of the inflated asset bubbles.

VCs and their "ORIGINAL" advise

But, what happens to the startups that have always relied on the next round of VC funding to stay afloat? Well, VCs have been quite clear that it's not going to be business as usual. And, they're now advising startups to "prepare for the worst".

The preparation includes building an 18-24 month runway. That is basically having enough capital to take care of the operational expenses for the next 18 months. So, that these startups don't crash and burn before things go back to normal.

But, how do these startups go about preparing for the worst? Well, VCs have some incredible advice:[6]

- Cut non-essential costs

- Explore more organic growth channels

- Revisit your unit economics

- Survival > Growth

- Revise assumptions on hiring

- Finally, take this seriously or you might drive your company off a cliff!

Does this sound familiar? Well, essentially, VCs are describing exactly how bootstrapped startups have been run for decades as original advice.

How interesting! But, you know what's more interesting? Well, there could be an upside to the downturn!

The recession storm can sieve hacks from well-run startups!

Now, you see, recessions, slowdowns, and downturns are common economic phenomena.

We witnessed it when the dot com bubble burst in 2001-2002, during the housing crisis in 2008, and during the Covid-19 pandemic in 2020. The market finds its way to correct the inflated valuations and excessive liquidity.

But, what's interesting is that the most resilient startups were founded during the previous economic crisis in 2008. Think Zerodha or Airbnb, Snapchat, and UBER, as an example.

So, downturns are literally a test for startups to see if they can survive solely on their business model without burning a ton of cash.

In a way, this gives downturns the power to separate well-run startups from "hacks", who'll have very little chance to survive. But, why?

Well, you see, a slowdown is the surest way to shift focus from "growth-at-all-cost" to the basics of running a business? Because the cost of not focusing on fundamentals could endanger survival!

So, startups will have to be cautious about blindly spending on marketing campaigns that don't produce enough value for the bucks invested. Like Unacademy's Rs 40 Cr spent on IPL ads!

The aim shifts to solving harder problems like:

- finding organic growth channels,

- fixing unit economics of your business model (looking at you Swiggy/Zomato!),

- cutting non-essential costs,

- and, finding a way to sustain your business without heavy reliance on external funding.

Now, considering how these businesses were run before you're probably wondering if running a company this way is even possible.

Well, other startups that forgo VC money don't need a recession to remind them of these fundamentals. In fact, companies that can't afford to burn cash have been running this way for years!

So, maybe these heavily funded giants could take a minute to study their bootstrapped brothers. As a result, they very well might make it to the other side of this recession.

But surely there is more bad news to come! Only time will tell 🙂

References:

[1] — Indian startups bag record $36 billion funds in 2021

[2] — Indian Startups Raised $14.3 Bn In Funding In The First Four Months Of 2022!

[3] — Global venture funding set to fall 19% in Q2 2022: report

[4] — How will the US Federal Reserve rate hike impact overseas portfolios