Cryptocurrencies are extremely volatile. There's no arguing that. But, how much money do you think a 30-year-old crypto trader, with untamed frizzy hair, wearing biker shorts and a grey loose t-shirt can lose in a fortnight?

Mere 20 days ago, Sam Bankman-Fried (SBF), the infamous co-founder of FTX, had a net worth of $16,000,000,000 ($16 billion dollars). That's until the number fell to ZERO, as a result of events that unfolded in the first 2 weeks of November.

His crypto exchange, FTX, the 2nd largest in the world, valued at $32B filed for bankruptcy. And, in its downfall, FTX and SBF

- sank $2 billion dollars worth of investor funds

- now owes north of $3 billion dollars to its top 50 creditors

- and, lost funds of more than a million people

But beautifully, with the crash, down came Sam Bankman-Fried's intricately weaved "billionaire saves the world" image. SBF's entire brand was based on the concept of effective altruism — that is giving away money to "noble" causes. But, whose money are we exactly giving away?

Well, let's find out how, mastermind Sam Bankman-Fried, fooled half of the world to run his unregulated crypto Ponzi scheme that defrauded millions of their hard-earned money. And, how in a matter of weeks, it all ran into the ground!

How did FTX come to be?

Sam Bankman-Fried was born in a house of academicians on the campus of Stanford University.

After graduating from MIT in 2014, he went straight to Wall Street. In 2017, he moved from the floor of Jane Street to work at the Center of Effective Altruism, where he indulged himself in his life philosophy. Here's where he met most of his close confidants, including the other antagonist of the story, Caroline Ellison.

In September 2017, SBF founded his hedge fund, Almeda Research, which was later led by Caroline.

At Almeda, Bankman-Fried made money via crypto arbitrage, moving upward by $25M per day!

What's crypto arbitrage you ask? Well, you see, the price of Bitcoin is different in exchanges across the globe. So, essentially, SBF would buy Bitcoin at a lower rate in America and sell it in the Japanese market.

But, merely running a hedge fund was obviously not enough considering Bankman-Fried's whole vision was earning billions to "give it away". So, in 2019, he founded a crypto exchange called FTX.

Now, SBF was running both FTX and Almeda Research, with a 90% stake in the latter.

Bankman goes from Billionaire to Bankrupt

FTX and SBF were an instant hit among investors and politicians alike.

When Bankman-Fried hopped on a call with Sequoia to raise funds for FTX, he was apparently playing League of Legends. The Sequoia investors couldn't get enough of this charm, with many proclaiming "I love this founder!".

Collectively a group of investors including Sequoia, Softbank, Tiger Global etc. gave him ~$1B in Series B funding. This was followed by a meme round, where FTX raised $420M dollars, from — you wouldn't guess it — 69 investors. How fun!

With enough money in his pocket, SBF grew FTX to the 2nd largest crypto exchange in the world just behind, CZ's Binance. And, he began going around Washington funding elections, creating Super packs and lobbying heavily for crypto.

Just in 4 years, during the crypto boom, SBF got the genius philanthropist status. But, well, the party couldn't go on forever. In November 2022, the whole scheme came crashing down.

Let's go through the events that unfolded in the last few weeks and break them down in detail.

A single move that unravelled the FTX scam!

Here's the entire timeline:

November 2nd, 2022 — Until November, everything was going super well, when CoinDesk, a crypto news site published a document containing the balance sheet of Almeda Research & how it had a large number of crypto tokens called FTT belonging to FTX.

So, Almeda relied entirely on a token that was created by its sister exchange and was not backed by other liquid dollars or assets.

November 6th, 2022 — Learning this, Binance CEO, Changpeng Zhao, announced that the company would be offloading all its FTT reserves.

November 8th, 2022 — As a result of the massive offload, FTT's price collapsed below $22, hitting both FTX and Almeda Research.

This run caused panic among FTX customers with traders on the platform scrambling to withdraw their actual dollars and assets from the exchange. This resulted in the withdrawal of $6B dollars of assets from FTX. Now, the exchange did not have the liquid funds to pay their customers. So, they had to be bailed out.

SBF went to Binance for help. And, Binance's CZ announced that he would gladly help out.

November 9th, 2022 — After evaluating FTX's balance sheets, Binance backed out of the deal citing the mishandling of funds of FTX and Almeda with a glaring $8B-$10B hole in the balance sheet!

November 10th, 2022 — FTX officially announced that they are shutting down operations and filing for bankruptcy.

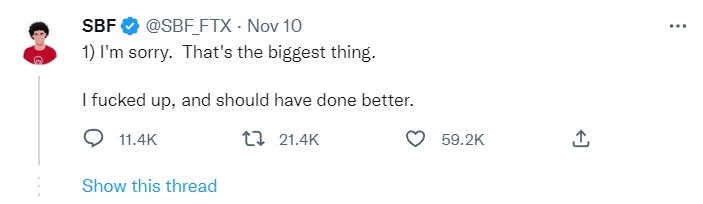

SBF very succinctly explains the whole scenario in a thread starting with:

Magical tokens that make infinite money

But, what exactly is the deal with these FTT tokens? Let's dig deep into the basics to understand this better.

1) FTX — It basically allows traders to engage in (speculative) trading of crypto derivatives. Works more like an online stock broker rather than a proper exchange like NSE or BSE. So, FTX pockets a small fraction of the funds for every trade.

2) Almeda Research — It is a hedge fund that trades cryptos and assets using FTX.

3) FTT tokens — These are the tokens issued by the FTX exchange. This behaves like stock, meaning the more people purchase it, the more its value increases. But, it's also not exactly a stock since you don't own a piece of a tangible asset like a company. These tokens are more like airline miles. Basically, discount tokens that FTX customers can use on the platform.

The token behaves like a stock because FTX uses a portion of its profits to buy back these tokens, inflating its prices. So if the company does well and its profits grow, the token's value also grows. So inherently, FTX's profits are tied to the value of these tokens.

On the flip side, the value of these FTT tokens will fall if they are sold in large numbers.

Now, Almeda, FTX's partner firm used FTT tokens as collateral to get loans in order to support its trades. This revelation was made in the CoinDesk article, and triggered the collapse of FTX.

You see, FTT tokens have been spun out of thin air by FTX. So, getting real money in exchange for this imaginary currency is outrageous!

More importantly, Almeda holding a huge amount of FTT and using it as a collateral for getting "real" money shows a close relation between two firms i.e. FTX & Almeda. Bankman-Fried had been assuring everyone that both companies are totally unrelated. So when this connection came out in public, it caused huge panic and mass withdrawal of funds.

So,

🚩 red flag 1 ⇒ Almeda holding large amount of FTT and using it as collateral for loans

🚩 red flag 2 ⇒ There was a glaring hole of $8B-$10B in the FTX's balance sheet. These are the funds that were apparently transferred from FTX to Almeda on Sam Bankman's orders.

🚩 red flag 3 ⇒ The biggest problem is that a large portion of these disappeared funds was actually the customer's money that was invested in FTX.

Seeing this mismanagement, unwarranted risks and borderline crime, FTX's current CEO John Ray, who is tasked to clean this mess, described this as the worst case of fraud he has ever seen, worse than Enron!

SBF: It was a PONZI scheme all along!

The FTX saga is a fraud tailor-made for the meme era.

In the Ponzi scheme metaphor, everything fits perfectly like puzzle pieces. How? Well, let me explain.

Ponzi Scheme

In a Ponzi scheme,

- The schemer basically takes money from their first investor and guarantees them HIGH RETURNS

- Now, with the large, first investment amount, the schemer gets credibility and more people make small investments.

- The schemer diverts part of these small investments to the first investor, fulfilling the promise of a high return and pockets the rest.

- The small investors are left hanging, till the whole scheme dries up.

Sam Bankman-Fried's magic box metaphor

Six months back, in a Bloomberg interview, SBF described his genius idea for FTX. And, the explanation was uncomfortably close to a Ponzi scheme.

- He described a box, that is a life-changing, world-altering protocol that would replace all banks.

- This amazing box issues a token. And, anything good that happens because of the box is rewarded to people holding that token.

- Now, since the box is awesome and the token is awesome, the token grows to a $20M market cap. Seeing the market cap, more and more people invest in the box driving up the value of this token. This apparently goes on forever.

When the host pointed out that this is absurd and that SBF was creating value out of nothing, SBF said that that was the "boomer" way of thinking.

And, as long as people believed in the box, everything should be fine. In the whole scheme of things, FTX is that box and FTT is the token. And, the belief in FTX drove its value to $32B.

But, since the whole scheme was merely suspended in the thin air of "belief". One doubtful move had the whole thing crashing.

A state full of doe-eyed onlookers

The beauty of this story is the fact that the blatant fraud was taking place in plain sight. But everybody was so enamoured by the supposed charm of Bankman-Fried, that the only thing they could do was look the other way.

That's especially the case with the doe-eyed Bankman lovers at Sequoia who sadly had to write in their $200M investment to FTX at ZERO.

But, that was SBF's long-term plan. Without the backing of Washington and investors, the whole thing wouldn't have flown for as long as it did. SBF needed everyone to believe in his vision and he paid good dollars for that belief.

Circling back to the first question I asked, "But, whose money are we exactly giving away?". It was not Bankman's hard-earned money but that of the millions of people who are now affected by this scam.

In the end, SBF's one goal with all this was to have an impact. And, although not positive, unfortunately, no one can deny that he surely had a huge impact.

%20(1).jpg)