What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost, or CAC, is one of the key metrics startups use to determine if they're on a path to success. In short, it's the total amount of money spent to acquire a new customer. This can be broken down into two main parts: what you spend marketing your service and what you spend compensating your employees for acquiring this customer (this includes all costs for sales and marketing).

As a startup progresses, it's useful to figure out whether your costs in these categories are greater than they should be. If they are, that's an indicator that there's room for improvement in how you acquire customers and grow your business. An easy way to do this is by using CAC as a benchmark: any time one metric in a category goes up (for example, compensation), but CAC doesn't go up by a similar amount (because of other areas where savings were found), then you know that change made things better.

"Online customer acquisition costs have increased and this is a good metric for entrepreneurs to look out for."

- Evan Speigel (Co-founder, Snapchat)

Want to learn more about the origin story of Evan Speigel? Read more about Evan Speigel’s origin story here.

How is customer acquisition cost calculated?

Customer acquisition cost is a key metric for any company that relies on repeat customers and has a complex sales cycle. This amount is calculated by looking at the costs of selling to a single customer, which usually includes both sales and marketing costs (advertising, salaries, travel expenses) and product development costs (costs of researching or developing the product or service).

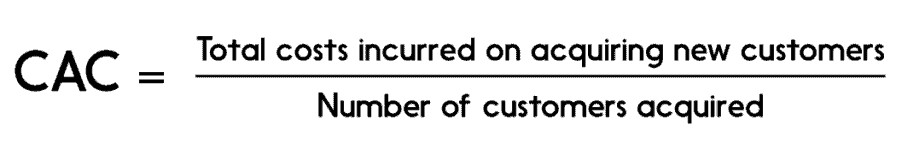

The formula is easy to understand:

For example, if you spend $5000 on Marketing/Sales and acquire 500 customers, your CAC would be $10 per customer.

In general, it's important to know how much it costs to get each new customer so you can make adjustments over time if necessary.

CAC vs LTV

Customer acquisition cost (CAC) is the total cost it takes to acquire a new customer. It's typically expressed as a dollar amount, but this can sometimes be difficult to calculate. The math is simple: when you enter a new market, you need to know how much money you're spending on advertising and other methods of bringing in customers. CAC helps you determine how quickly that money will be recouped by your business, so it's an important metric that helps guide your decision-making processes.

LTV is actually short for lifetime value, your LTV for customers equals the revenue generated by a customer over the course of their lifetime with your business. This could be in the form of repeated purchases, service fees or whatever else—it's just an overall measure of what they would generate for your company if they were there forever. Calculating LTV takes into account things like average purchase prices and repeat rates, so it's not as simple as multiplying price by number of purchases; but without LTV information first, CAC calculations are useless because they don't provide context to whether you should even invest in this customer to begin with.

Factors affecting customer acquisition cost

CAC can be useful when deciding where to focus marketing efforts and how much to spend on acquiring customers. If a business has high CAC, then the business should focus on reducing its CAC by improving marketing channels or targeting more relevant markets.

The factors that determine CAC include:

- Marketing channels: The most obvious factor in determining CAC is the marketing channel being used. The costs of advertising on social media platforms like Facebook can be far less than those associated with an outbound sales campaign, due in large part to the saturation of Facebook users who are already interested in your product category. On the other hand, outbound sales through cold calls may attract higher quality leads but also require more time and resources on the part of your sales team than Facebook ads do.

- Target market: Customer segmentation plays a big role in determining CAC because each segment has different prices/value and target customers have unique buying and conversion behaviors as well. When evaluating your customer segments, consider what behavioral traits they have in common (e.g., their willingness to pay or their level of influence) and find ways to leverage this information. For example, by pricing products higher for resellers who have more purchasing power with clients than individual buyers do, or by focusing marketing efforts toward larger companies rather than individuals if you're selling enterprise software and want guaranteed long-term revenue streams from contracts with large organizations instead of single purchases from small businesses over time.

- Sales process/length of the sales cycle: Another variable affecting your customer acquisition cost is how much work goes into making a sale that is, how long is the sales process. Different industries have different average lengths here; they range from high-tech industries at 5–6 months AVE (average value/annual equivalent) all the way down to

How can you improve your customer acquisition cost?

Customer acquisition cost (CAC) is the figure you see in business plans and other financial documents when talking about startups and other ventures. It's calculated by taking your sales, marketing, and general expenses that go toward acquiring customers, then dividing it by the number of new customers you acquired during a specified period of time.

Here are a few ways businesses can reduce their CAC:

- Increase conversion rate - Make sure there is no reason for your potential customers to leave your landing page or website before buying. If they're confused about what steps need to be completed or what is expected of them, the site will lose its appeal. Customers have short attention spans online and often visit multiple sites within a single session. Create an effective purchase process that is free from distractions or confusing language/layouts. Reduce the number of steps people have to take until they reach your sales page as much as possible without losing value early on in the process.

- Reduce marketing costs - Having more traffic isn't always better! Take some time to determine which social media platforms apply best to your business, then focus on those exclusively until you've seen enough results from them before moving onto another platform (for example Facebook).

- Content Marketing - Marketing success always comes down to content. The guides and collateral you produce, blogs, the ad copy that promotes them (and other non-content offers). If you want to lower your customer acquisition costs, Content marketing is one of the best ways to go about it.

Entrepreneurship

Entrepreneurship