VC-funded startups are media DARLINGS!

If your startup gets funded, you're considered successful. Doesn't matter if you've a viable business or not.

In this funding-obsessed environment, Zerodha's founders, the Kamath brothers, have managed to buildd a truly successful business. Not just that, in a very real sense, they have "disrupted" the traditional broking industry in India.

Consider these numbers, for instance. In FY22, Zerodha's profits jumped by 50% from INR 1122 Cr profits in FY21. And, its revenue is estimated to reach INR 4300 Cr.

All this with:

- ZERO spend on advertising

- No direct marketing

- No VC funding

- And, INCREDIBLE growth during the pandemic!

So, how did Zerodha do this?

Well, here's the story of a 30-year-old trader who had the courage to spend all his savings on building a brokerage firm during the cusp of the 2008 financial crisis!

The story of the Kamath brothers!

Nithin Kamath's journey is quite unique. For most of his life, Nithin has worked as a trader.

He started trading when he was 17, mostly influenced by his Marwari friends. Later, in the early 2000s, derivatives trading was first introduced in India. So, Nithin started trading online and in the first of many instances, he went bust in 2002!

Just to support himself, Nithin was working at a call center at night, so he could trade during the day.

This went on for several years until 2005 when Nithin met an acquaintance at the gym who was super impressed by Nithin's trading portfolio. He handed Nithin an INR 25 lakh cheque to handle his demat account.

With this opportunity, Nithin could quit his call center job and trade full-time!

He received several more accounts to handle. But, there was no single online terminal that allowed him to switch between these accounts with ease.

So, in 2006, Nithin joined Reliance Money as a sub-broker which gave him access to a single platform to buy and sell from all his accounts. He continued working as a sub-broker till 2008-09.

While Nithin was building his career as a trader, his younger brother Nikhil, a chess wiz, dropped out of school to play Chess full time! Nikhil also started trading as a teen following in his brother's footsteps. He later became a sub-broker with Way2Wealth.

The age-old Indian brokerage industry needed a change!

The brokerage industry is a 145-year-old fossil. Typically, old-school trading communities are tight-knit groups that mostly operate in their own circles.

This includes all the traditional broker firms that are used to operating in their age old, rigid ways.

In 2009, by the time the idea of Zerodha started brewing, Nithin had already worked with several different brokerage firms. So, he knew the industry in and out.

With Zerodha, he simply wanted to become a broker he never had.

He decided that the industry needed a makeover on several different fronts:

- The lack of transparency: The brokerage system was built to be complex and opaque. This allowed middlemen to take advantage of the lack of transparency to make extra money.

- Offline operation: Sub-brokers had access to an online terminal, but all other operations or interactions took place offline.

- Percentage brokerage fee model: For every trade made, a percentage of that trade would be charged as a fee to the broker (x% of INR 1000).

- Limited reach: During that time, only 20-30 lakh people were trading actively on the stock exchange.

Nithin's focus was to solve problems on these 4 fronts, which would make Zerodha a game-changer in the coming years!

2010s: The early days of Zerodha

Now, let's go back to 2010. It'd been only 2 years since the financial crash. The global and the Indian economy were both HIT hard!

During that time, approximately $12B dollars worth of investment was withdrawn from the stock market.

In contrast to the grim year everyone else had, Nithin Kamath had just struck the JACKPOT. Like the savvy trader he is, Kamath had short the market, which produced ~900% returns!

Burned out from trading, Nithin suggested his younger brother carry on with trading. He, instead, decided to focus on building Zerodha.

Having gone bust several times in his career, Nithin initially did seek VC funding. But, no VC was keen on funding an online brokerage firm after 2008.

So, Nithin spent INR 1.7 Cr he had saved up to get things started. Majority of this money went into buying exchange refundable deposits & creating a workable office space. With everything in place, it was showtime!

The New Model: How was Zerodha different?

Next, Zerodha had to differentiate itself from its competitors. They had to replace the traditional model with the new model. Here's how they did it!

1) Lack of transparency

The first thing Zerodha did to tackle this was to post a simple Brokerage Calculator. This was just a simple excel sheet added to the website!

All you have to do is enter the buy and sell price along with the quantity and it will automatically calculate your total charges.

Today, instead of an excel sheet, you'll find a dedicated page for a brokerage calculator that looks like this.

2) Offline operation

Well, this bit was simple. The entire idea was to buildd a digital platform that helped people trade directly online.

The tricky part, however, was going to be to change behaviour and push people to use the online platform.

3) Percentage brokerage fee model

Since the size of trade didn't affect the operation cost whatsoever, Zerodha went ahead with a flat fee model. For each order, you have to pay a flat fee of INR 20.

Let me explain this with an example.

Typically, a broker would charge you 0.5% per trade.

So, if your trade value is

- INR 1000 ⇒ INR 5 fee

- INR 1,00,000 ⇒ INR 500 fee

So, for large trade values, your broker fees will also go up. But, in the flat fee model, for both INR 1000 and INR 1,00,000 the fee would remain INR 20!

4) Limited scope

Now, given only ~30 lakh people were trading at that time, Nithin's goal was to make trading accessible and easy to learn.

In the beginning, Nithin started writing blogs that would cover basic trading-related terms, give market advice, etc. Today, Zerodha has a separate product called Zerodha Varsity that has curated educational content on trading!

So, while Zerodha targets an existent pool of traders, it's also worked towards expanding that pool. This strategy has done wonders for their user growth.

Zerodha was solving the right problems, but was that enough?

At that time, Zerodha's operational model was a game-changer. So much so that they received threats from traditional brokers over their flat fee model!

On paper, Zerodha was a perfect solution for traders. But, having a perfect product is never enough to start getting the first few customers you desperately need. In fact, it took Zerodha a couple of years to truly get the momentum it has today!

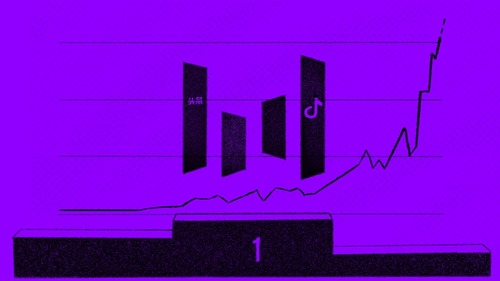

Now, you know the Kamath brothers didn't spend money on ads. So, how did Zerodha work on acquiring customers? And how did the number of users go from 0 to 6.5M in just 12 years?

Well, we'll be covering Zerodha's marketing strategy and more in the next article. So, stay tuned!